“Promotional activity appeared more aggressive than anticipated,” Deutsche Bank said.

Xpeng (NYSE: XPEV) reported third-quarter earnings today, and as usual, Deutsche Bank analyst Edison Yu’s team shared their first look.

Here’s what came out of the team’s research note.

XPeng delivered somewhat mixed results and guidance albeit against rising investor expectations recently.

Deliveries for 3Q23 were already reported at 40,008 units, leading to revenue of 8.5bn RMB vs. consensus/DBe 8.6/8.8bn, hurt by lower than expected ASP.

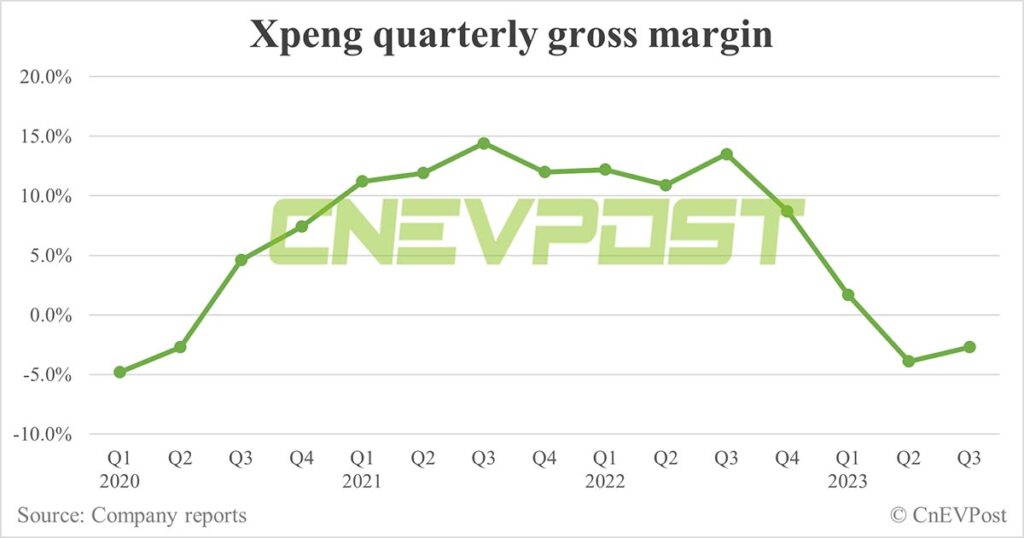

Gross margin remained weak, increasing only 120bps QoQ to -2.7%, missing our 0.8% estimate, driven by lower vehicle margin of -6.1% vs. our -1.9%.

Promotional activity appeared more aggressive than anticipated. Opex of 2,998m was largely consistent with our estimates.

All together, EPS of (3.23) came in below our (2.87). Operating cash flow was positive in the qtr, benefitting from favorable WC dynamics.

Management provided a mostly solid 4Q23 outlook, calling for 59,500-63,500 deliveries, slightly lower than our 65,000 forecast, translating into 12.7-13.6bn RMB in revenue.

This implies Nov/Dec to be flattish at the mid-point considering Oct garnered 20,002 units; implied ASP appears generally softer, about ~3% lower than modeled.

On the earnings call, we will look for further commentary on the vehicle margin trajectory, competitive landscape (in the context of several new models hitting the market at aggressive price points), and initial views toward 2024.

Xpeng Q3 revenue slightly below expectations, gross margin still negative