Gotion’s net profit for the first half of the year reached RMB 209 million, up 223.75 percent year-on-year.

Volkswagen-backed Chinese power battery giant Gotion High-tech saw its second-quarter net profit jump as it saw shipments grow and costs fall.

Gotion’s net profit attributable to shareholders reached RMB 209 million ($28.7 million) in the first half of the year, up 223.75 percent year-on-year, according to its semiannual report released last night.

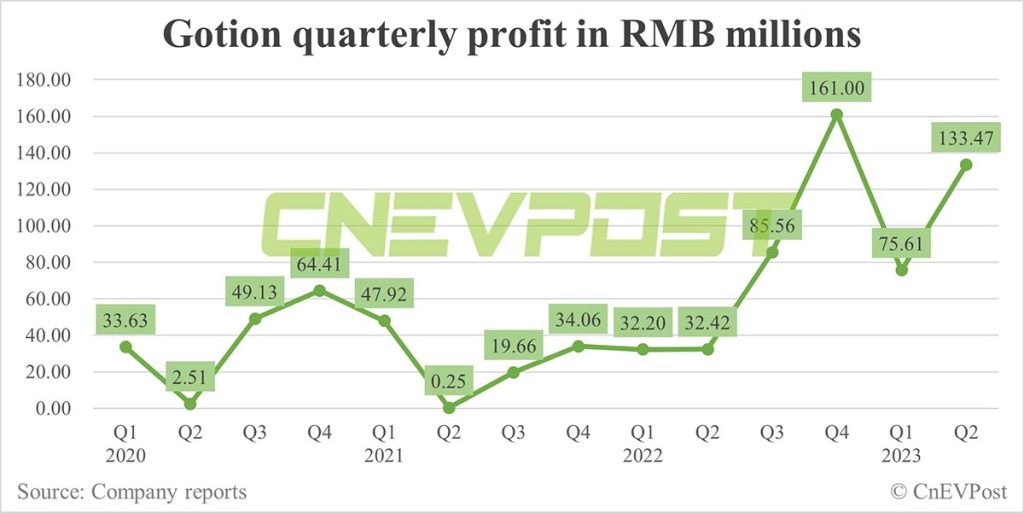

Considering the company’s net profit of RMB 756.1 million in the first quarter, that means it had a net profit of RMB 133 million in the second quarter, up 311.69 percent year-on-year and up 76.52 percent from the first quarter.

Gotion’s revenue in the first half of the year was RMB 15.239 billion, up 76.42 percent year-on-year.

In the second quarter, Gotion’s revenue was RMB 8.06 billion, an increase of 70.76 percent year-on-year and up 12.26 percent from the first quarter.

The power battery and energy storage battery businesses are the main sources of Gotion’s revenue.

In the first half of the year, Gotion’s power battery business generated revenue of RMB 10.05 billion, up 58.56 percent year-on-year, and accounted for 68.76 percent of total revenue.

Its energy storage business generated revenue of RMB 4.15 billion in the first half, up 224.33 percent year-on-year, accounting for 27.21 percent of total revenue.

Gotion continued to optimize its EV customer mix in China, adding several new partnerships in the first half, while demand in the new energy storage market was rapidly releasing, it said.

Gotion’s overall gross margin improved in the first half, as costs fell.

The company’s power battery business gross margin was 13.22 percent in the first half, up from 12.49 percent in the same period last year, and its energy storage battery business gross margin improved to 17.43 percent from 10.24 percent in the same period last year.

This was mainly due to the company’s completion of the whole industry chain layout from mineral resources, materials, electric cells, Pack to recycling, which guarantees a stable supply of raw materials and realizes cost reduction, it said.

In the first half of the year, Gotion realized revenue of RMB 3.062 billion overseas, a year-on-year increase of 296.74 percent, exceeding its full-year 2022 overseas revenue.

Overseas business revenue contributed 20.09 percent of Gotion’s total revenue in the first half, up from 8.94 percent in the first half of 2022.

Declining prices of battery raw materials, especially lithium carbonate, helped Gotion’s earnings growth in the first half of the year.

The price of battery-grade lithium carbonate in China fell 41 percent in the first half from RMB 517,500 per ton to RMB 306,000 per ton, according to Mysteel.

Gotion installed 3.41 GWh of power batteries in China in the second quarter, up 15.59 percent year-on-year and up 29.17 percent from the first quarter, according to China Automotive Battery Innovation Alliance (CABIA).

In the first half of the year, Gotion’s installed base of power batteries in China amounted to 6.05 GWh, up 9.60 percent year-on-year.

($1 = RMB 7.2807)

China EV battery installations in Jul: CATL share falls to 41.79%, BYD rises to 29.01%