China’s lithium battery industry’s overcapacity will continue into 2024, and battery prices will still decline next year, TrendForce said.

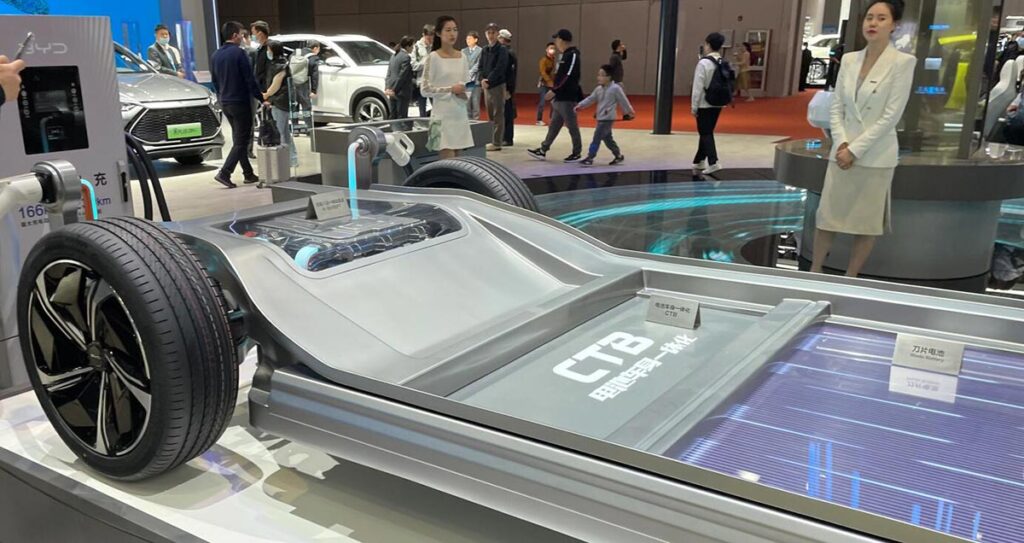

(Image credit: CnEVPost)

In addition to lithium carbonate, which is a key raw material for batteries, China’s lithium battery industry is also facing overcapacity.

China’s lithium battery industry overcapacity will continue into 2024, and power battery prices will still decline next year, market research firm TrendForce said in a report released on Friday.

China’s lithium battery exports will still perform well in 2024, but the continued release and climb of new capacity this year will lead to a continuation of the overcapacity situation, the report said.

China’s average power battery cell prices remained in a downtrend in October, albeit at a smaller rate than in August and September, the report noted.

Power cells for electric vehicles (EVs) fell about 2 percent in October from September, lithium cobaltate cells for consumer electronics fell 1.3 percent month-on-month, and energy storage cells saw the highest drop, falling 3.3 percent month-on-month, according to TrendForce.

The average price of square ternary cells for EVs was RMB 0.57 ($0.078) per Wh in October, down 2.2 percent from September, according to TrendForce.

The average price of square lithium iron phosphate (LFP) cells was RMB 0.52 per Wh in October, down 2.4 percent from September. The average price of soft pack ternary cells was RMB 0.61 per Wh in October, down 2.2 percent from September.

The average price of square LFP cells for energy storage was RMB 0.5 per Wh in October, down 3.3 percent from September.

The fall in battery cell prices is also dragging down the prices of upstream raw materials.

Due to the overall lack of demand in the power battery market, the willingness of battery cell manufacturers to replenish inventory has been reduced, leading to a continued decline in lithium battery raw material prices, TrendForce said.

Battery-grade lithium carbonate was quoted at RMB 165,000 per ton on November 7, down RMB 1,000 per ton from the previous day, the ninth consecutive day of decline, according to daily quotes from Mysteel monitored by CnEVPost.

Since June 25, the average price of battery-grade lithium carbonate has fallen 48 percent from RMB 315,000 a ton.

An imbalance between supply and demand is the main reason for this round of sustained declines in lithium carbonate, and several industry watchers believe that current prices have not bottomed out, according to a report in Securities Daily earlier today.

($1 = RMB 7.2783)

Lithium carbonate prices keep falling as supply-demand imbalance fears persist