As demand in the power and energy storage battery markets cools, cell makers have adjusted their capacity utilization rates downward to reduce inventory.

Some power battery makers may be forced to halt production as prices continue to fall due to weak demand.

Amid fierce competition, some Chinese battery cell makers will face production cuts or shutdowns due to a lack of orders, market research firm TrendForce said in a report released on December 4.

As demand in the power and energy storage battery markets cooled, cell makers adjusted their capacity utilization rates downward to reduce inventories, causing the industry’s overall start rate to drop to less than 50 percent, the report said.

At the same time, due to increased pressure on shipments, some cell suppliers are selling their products at low prices to speed up inventory clearing, and the market has thus fallen into a price war, TrendForce said.

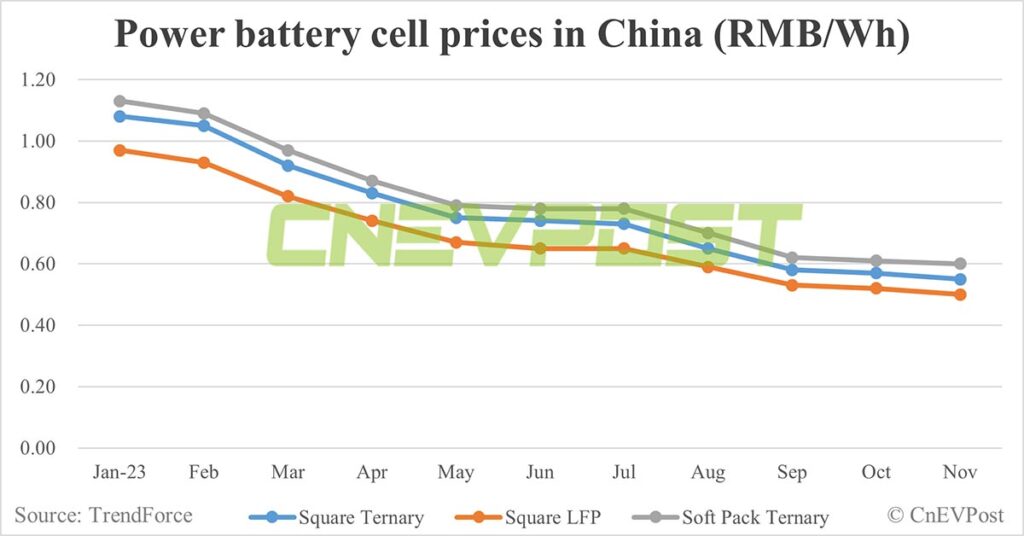

In particular, as the Chinese market entered the off-season in November, the lowest offer price for energy storage batteries has fallen to about RMB 0.4 ($0.056) per Wh, the report said.

As demand cooled significantly, China’s battery industry saw a decline in start-up rates in November, and prices for lithium, cobalt and nickel raw materials all fell, leading to a downward spiral in the price of batteries.

In November, China’s electric vehicle (EV) battery cell prices fell about 3~4 percent month-on-month, consumer electronics lithium cobalt coated battery cells fell 2.5 percent month-on-month, and energy storage battery cells continued to see the highest decline, down 6.8 percent month-on-month, according to TrendForce.

In the fourth quarter, demand in the power battery and energy storage battery markets remained weak, and the capacity utilization rate of cell manufacturers continued to decline, the report noted.

Companies’ inventory adjustments will likely be delayed, and some may face production shutdowns, TrendForce said.

With sluggish downstream demand, the price decline of upstream lithium raw materials will not stop easily, TrendForce said, adding that even though the supply growth rate is slowing down, it is still no match for the slowdown in downstream demand, and thus the market for power battery products remains oversupplied in the short term.

The price of lithium carbonate continues to fall in China, with the average price of battery-grade lithium carbonate at RMB 129,500 per ton on December 4, down RMB 2,000, or 1.52 percent, from the previous trading day, according to Mysteel.

So far this year, the average price of battery-grade lithium carbonate in China has fallen about 73 percent from nearly RMB 520,000 per ton.

The lack of demand in China’s lithium battery industry will continue in the first quarter of 2024, and it is unlikely to see demand warm up until at least the second quarter of next year, the report said.

On the supply side, the accelerated exit of capacity that doesn’t have a cost advantage, such as those that lag behind in terms of energy consumption and productivity or are smaller in scale, is expected to slow the growth of supply and accelerate the return of supply and demand to normal in the power battery market, the report said.

($1 = RMB 7.1374)

BYD signs deal with local conglomerate to build sodium battery base with 30 GWh annual capacity