Nio reported mixed fourth-quarter results while providing a better than feared first-quarter outlook, said Deutsche Bank.

Nio (NYSE: Nio) reported its fourth-quarter 2023 earnings today, showing that its revenue for the quarter exceeded expectations while gross margins missed estimates.

As usual, Deutsche Bank analyst Edison Yu’s team shared their first look of the results.

Here’s what they had to say.

4Q23 Earnings First Look

Nio reported mixed 4Q results while providing a better than feared 1Q24 outlook.

Deliveries for the fourth quarter were already reported at 50,045 units, leading to revenue of 17.1bn RMB, better than DBe/consensus 16.9/16.8bn due to higher ASP.

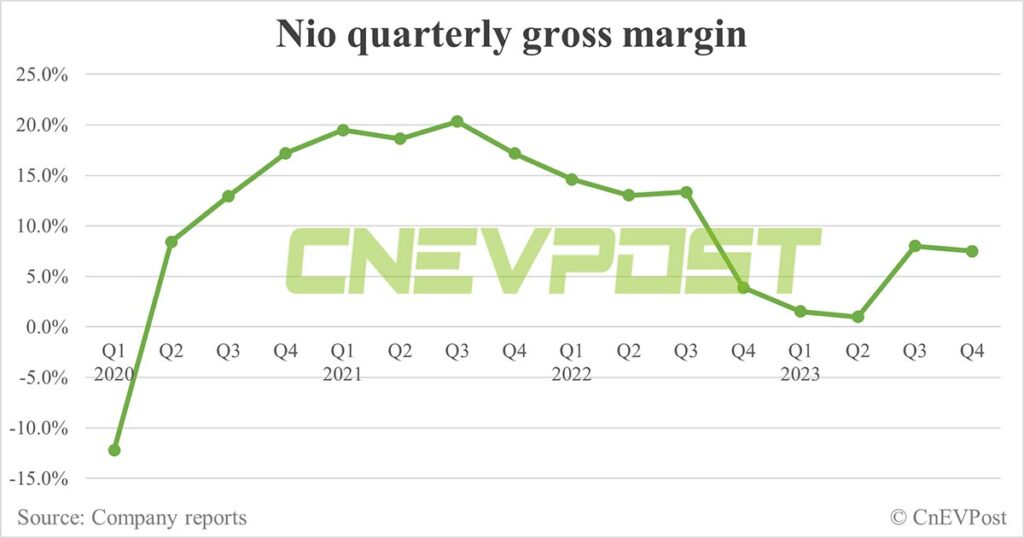

Gross margin of 7.5% was below our 9.7% forecast (consensus 10.2%), driven by weaker vehicle margin (11.9% vs. our 13.5%) and other margin (-33.6% vs. our -23.0%).

Opex of 7.9bn was above our expectations of 7.2bn, mainly on notably higher R&D.

All together, adjusted EPS of (2.81) came in only slightly worse than our model (DBe/consensus at -2.69/-2.70), boosted by investment income related to recycling of unrealized gain from other comprehensive income to investment income (nearly 980m RMB).

Management provided a better than feared outlook for 1Q24, calling for 31,000- 33,000 deliveries (10.5-11.1bn RMB in revenue).

This compares to our expectation for mid 20,000 and suggests March will rebound meaningfully from Feb’s 8,132 units.

The implied ASP is down materially QoQ, hurt by the incentives on MY23 inventory.

Management expects vehicle margin to be under pressure in 1Q but then recover to 15-18% in 2Q driven by higher volume, MY24 model mix, and cost optimization.

R&D is expected to be about 3bn per qtr in 2024 and full-year capex should be significantly lower on a YoY basis.

Nio Q4 earnings: Revenue beats estimates, gross margin falls short