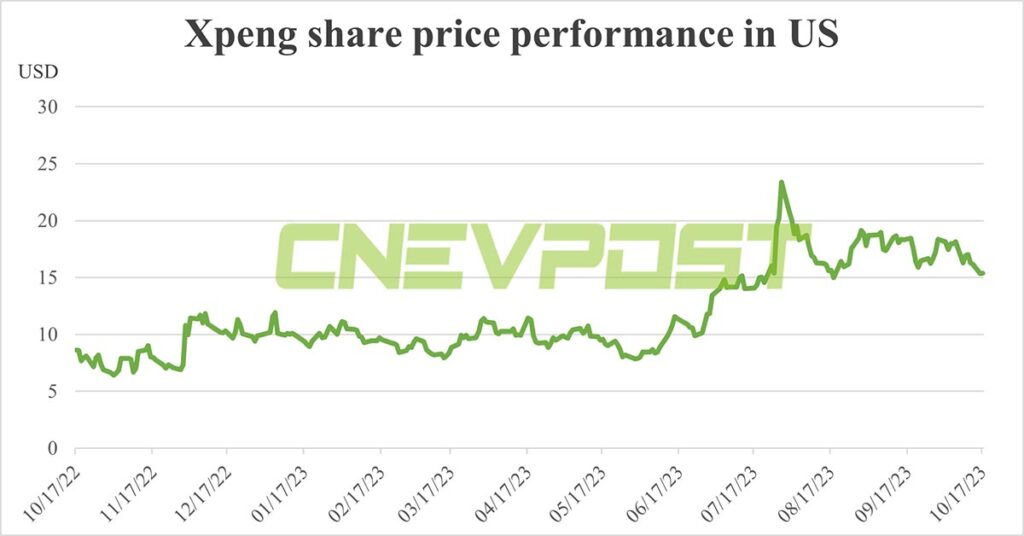

Shares of Xpeng have fallen back to the level prior to the Volkswagen deal, despite improving operations and strategic opportunities, Morgan Stanley noted.

Xpeng (NYSE: XPEV) has lagged two other peers — Nio (NYSE: NIO) and Li Auto (NASDAQ: LI) — over the past week, falling 4.89 percent in the US on Monday. Analysts at Morgan Stanley shared their thoughts on this in a research note, remaining bullish on the Chinese electric vehicle (EV) maker.

Worries over competition and, to a lesser extent, third-quarter margin, dampened share price performance: the ADR of Xpeng fell 4.9 percent on Monday, while Nio gained 0.6 percent and Li Auto fell 2.3 percent, Tim Hsiao’s team said in a research note on Tuesday.

This could be due to growing investor concerns about competition in the fourth quarter after the launch of the LS6 SUV by IM Motors, SAIC’s EV unit, at lower-than-expected price, the team said.

Further, given the strong order momentum for Huawei-backed Aito’s new M7, as well as the Huawei Luxeed S7 to be launched in November, investors are taking a more cautious stance, according to the team.

As a backdrop, IM Motors launched the LS6 on October 12 at a starting price of RMB 229,900 ($31,450), making it the least expensive in the company’s product array.

Luxeed, a new EV brand jointly created by Huawei and Chery, will release its first model, the Luxeed S7, in November, a sedan that will outperform Tesla‘s Model S in every specification, Richard Yu, chairman of Huawei’s smart car solutions business unit, said at a September 25 event.

In addition to more competition, Hsiao’s team noted the slow ramp-up of G6 production capacity as a factor dampening Xpeng’s stock price.

“Separately, while we expect a rising sales mix of Xpeng’s G6 model to underpin a sequential margin improvement in the longer term, its production is being hindered by component constraints,” the team wrote.

Xpeng launched the G6 in China on June 29, with volume deliveries starting on July 10. A total of 8,132 units of the G6 were delivered in September, up 15.05 percent from 7,068 units in August.

By the end of September, the G6’s cumulative deliveries since launch stood at 19,381 units, data monitored by CnEVPost show.

Xpeng’s significant expansion of G6 production capacity has accelerated deliveries of the model, Xpeng said on October 1.

In addition, Hsiao’s team believes Xpeng is on track to launch a new variant of the Xpeng P7i sedan with lithium iron phosphate (LFP) battery packs later this month. Xpeng has done this in the past by bringing down the starting price by launching a version with lower-cost LFP battery packs.

Clearing out legacy P7 models before launching the new LFP-P7i later this month and more aggressive promotions could also affect a significant improvement in Xpeng’s third-quarter margins, pushing the recovery into the fourth quarter, Hsiao’s team said.

On the bright side, Xpeng’s operating stats look good, as order intake in September was in the 20,000-30,000 range, with the G6 accounting for 35-40 percent and the G9 40-45 percent, the team said.

“We believe the order backlog will underpin the company’s monthly target of sequential growth towards the 20k level in 4Q,” the team wrote.

Morgan Stanley said the recent pullback has created a buying opportunity, maintaining an Overweight rating on Xpeng.

“While investor concerns over China’s macro outlook and greater competition from tech names, such as Huawei, could see further share price volatility, we note that Xpeng’s shares have fallen back to the level prior to the VW deal (Jul 26), despite improving operations and strategic opportunities,” the note wrote.

Xpeng has not yet announced that it will launch the P7i sedan with LFP battery packs. The company said earlier today that it will hold its annual Tech Day event on October 24, as it has done before, in Guangzhou, where it is headquartered.

($1 = RMB 7.3096)

(Xpeng’s poster for the October 24 Tech Day event.)