The Hang Seng Index is one of the earliest stock indices in Hong Kong, and since its launch on November 24, 1969, it has become an important indicator of Hong Kong’s stock market.

Li Auto (NASDAQ: LI) will be included in Hong Kong’s benchmark stock index early next month and is expected to receive inflows from passive funds tracking the index.

Li Auto, along with pharmaceutical company WuXi AppTec, will be added to the Hang Seng Index, with the change due to take effect on Monday, December 4, the Hang Seng Indexes Company Limited (HSI) said in a quarterly review released today.

With the addition of the two companies, the number of constituent stocks in the Hang Seng Index will increase from 80 to 82.

The Hang Seng Index, one of Hong Kong’s earliest stock indexes, has become an important indicator reflecting Hong Kong’s stock market since its launch on November 24, 1969, a description on the HSI website showed.

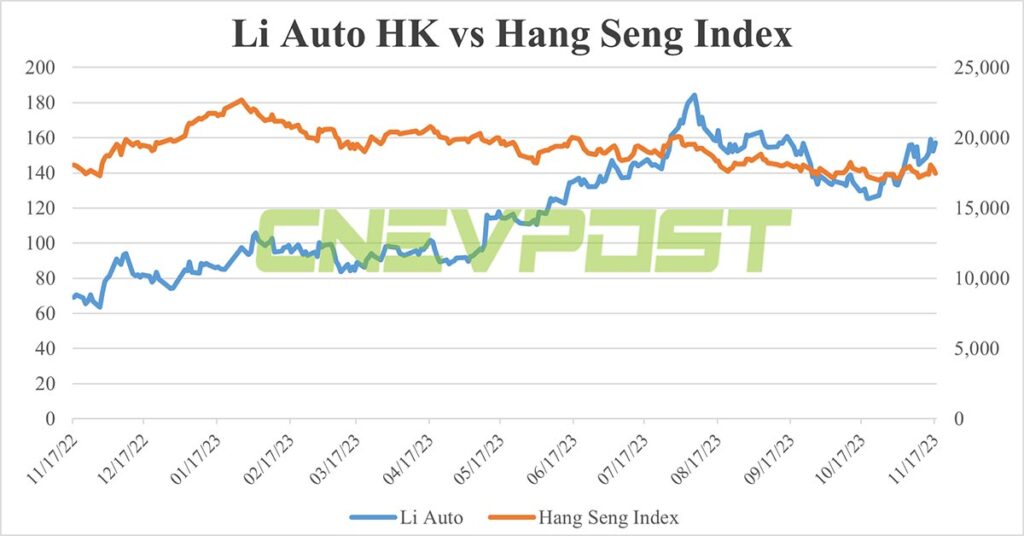

However, Hong Kong’s stock market has been weak this year, with the Hang Seng Index down about 12 percent so far this year as of today’s close.

Li Auto made its secondary listing in Hong Kong on August 12, 2021, with a dual primary listing, meaning both New York and Hong Kong are its primary listing venues.

Li Auto’s local peer Xpeng (NYSE: XPEV) made its secondary listing in Hong Kong on July 7, 2021, also listed there under a dual primary listing.

Nio (NYSE: NIO), on the other hand, listed in Hong Kong on March 10, 2022 by way of introduction, with no new share issue involved.

In addition to the Hang Seng Index, Li Auto had previously been included in the Hang Seng Tech Index and Hang Seng China Enterprises Index.

Xpeng has also previously been included in the Hang Seng Tech Index and Hang Seng China Enterprises Index.

Nio was included only in the Hang Seng Tech Index from June 13, 2022 onwards.

Secondary vs dual primary: How is NIO’s planned HK listing different from XPeng and Li Auto?