Li Auto announced last June 28 that it would sell up to a total of $2 billion in ADSs on Nasdaq in an ATM stock offering program.

Li Auto (NASDAQ: LI) announced the early termination of a $2 billion fundraising program announced last year, driving its shares higher in premarket trading Wednesday.

Li Auto terminated its at-the-market (ATM) share offering plan announced on June 28, 2022, effective immediately after the close of business on September 27, US Eastern Time, according to its SEC filing today.

The company is terminating the ATM offering because it does not intend to raise further additional funds or sell additional securities under the ATM offering after the termination becomes effective, it said.

Li Auto announced on June 28 last year that it would sell up to an aggregate of $2 billion in American Depositary Shares (ADSs), each representing two class A ordinary shares of the company, under an ATM stock offering program on Nasdaq.

Li Auto intended to use the net proceeds of the offering for research and development of next-generation electric vehicle (EV) technologies, including BEVs, smart cockpits and autonomous driving technologies, it said last year.

It also planned to use the funds to develop and manufacture future platforms and vehicle models, as well as for working capital needs and general corporate purposes, according to last year’s announcement.

To date, Li Auto has sold 13,502,429 ADSs under the ATM offering, equivalent to 27,004,858 class A ordinary shares of the company, it said today.

Li Auto raised gross proceeds of $536.4 million through the offering, before deducting up to $7 million in fees and commissions payable to the selling agent and certain other offering expenses, it said.

The company said it has used, and will still intend to use, the net proceeds from the ATM offering for:

(i) research and development of next-generation electric vehicle technologies including technologies for BEVs, smart cabin, and autonomous driving, (ii) development and manufacture of future platforms and car models, and (iii) working capital needs and general corporate purposes.

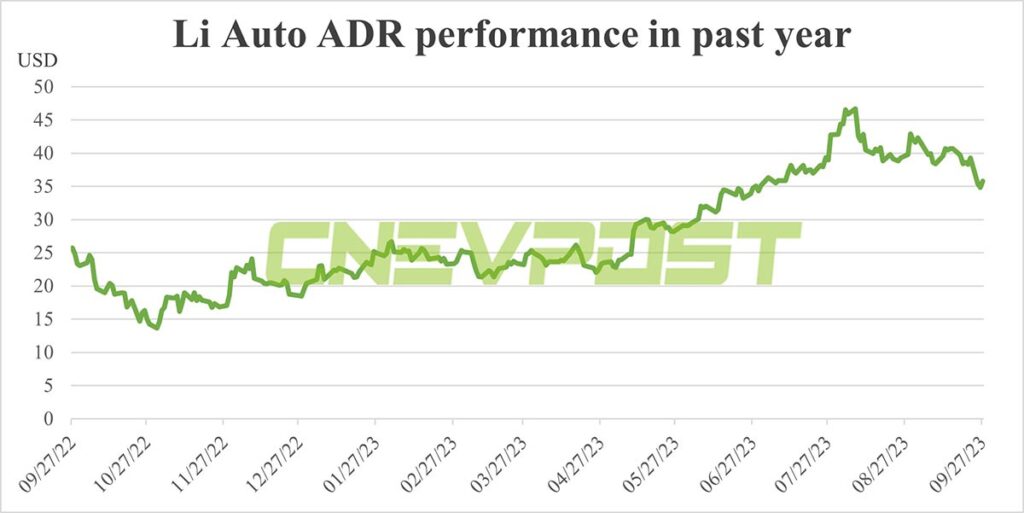

Li Auto shares were up in pre-market trading on Wednesday, rising 2.84 percent to $35.80 at press time.

The move comes after Li Auto fell 24 percent in the US since August 7, potentially removing a negative factor weighing on its valuation.

Terminating the ATM offering early appears to be a good deal for Li Auto, as the company has seen strong deliveries this year, resulting in strong cash flow.

Li Auto delivered a record 34,914 vehicles in August and has delivered more than 30,000 vehicles in each of the past three months.

In the second quarter, Li Auto reported a record revenue of RMB 28.65 billion ($3.92 billion) and net income of RMB 2.31 billion.

Li Auto’s gross profit margin for the second quarter was 21.8 percent, and vehicle profit margin was 21.0 percent.

As of June 30, Li Auto’s cash and cash equivalents, restricted cash, time deposits and short-term investment balances were RMB 73.77 billion.