CATL‘s share of the global EV battery market in Jan-July declined slightly from Jan-June, while BYD increased.

Chinese power battery giant CATL saw its share of the global electric vehicle (EV) battery market slip slightly in January-July from January-June, while BYD (OTCMKTS: BYDDY) rose.

Global EV battery consumption totaled 362.9 GWh in the January-July period, up 49.2 percent from 243.2 GWh in the same period last year, according to data released today by South Korean market researcher SNE Research.

CATL installed 132.9 GWh of batteries from January to July, up 54.3 percent from 86.1 GWh in the same period last year.

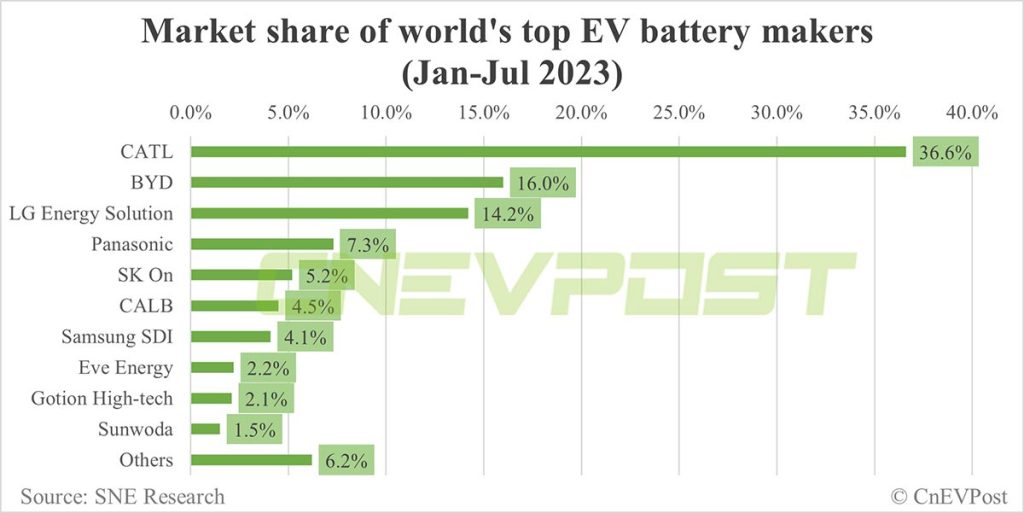

The Chinese power battery giant continued to rank No. 1 in the world with a 36.6 percent share from January to July, and remained the only battery supplier in the world with a market share of more than 30.0 percent.

This was higher than its 35.4 percent share in the same period last year, but lower than its 36.8 percent share in the January-June period.

In addition to China’s domestic market, CATL has entered overseas markets, growing rapidly in Europe and North America, the SNE Research report noted.

CATL’s batteries are installed in many of the major passenger EV models in the Chinese domestic market, such as the Tesla Model 3, Model Y, GAC’s Aion Y, SAIC’s Mulan, and commercial vehicle models in China, and continue to grow steadily, the report said.

BYD’s power battery installations from January to July amounted to 58.1 GWh, up 94.1 percent from 29.9 GWh in the same period last year.

The new energy vehicle (NEV) and battery giant ranked second with a 16.0 percent share in the January-July period, up from 12.3 percent in the same period a year ago and up from 15.7 percent in the January-June period.

BYD has gained popularity in China’s domestic market with its price competitiveness by establishing vertically integrated supply chain management, including battery self-sufficiency and vehicle manufacturing, SNE Research said.

BYD is expanding its market share outside China in Asia, Oceania and Europe, centered on the Atto 3, SNE Research noted.

LG Energy Solution’s power battery installations in January through July were 51.4 GWh, up 53.2 percent year-on-year.

The South Korean company ranked third in the world with a 14.2 percent share, slightly up from 13.8 percent in the same period last year but down from 14.5 percent in the January-June period.

Japan’s Panasonic was fourth with a 7.3 percent share, South Korea’s SK On was fifth with a 5.2 percent share, and China’s CALB was sixth with a 4.5 percent share.

South Korea’s Samsung SDI, China’s Eve Energy, Gotion High-tech, and Sunwoda ranked seventh, eighth, ninth, and tenth, respectively, with shares of 4.1 percent, 2.2 percent, 2.1 percent, and 1.5 percent from January to July.

Following the US, Europe, China and Japan, South Korea has presented a national strategic technology development roadmap that includes the secondary battery sector, SNE Research said.

South Korea’s three major battery companies are accelerating the expansion of their battery plants in Europe and the US, which is expected to help them maintain their market leadership, the report said.

CATL to produce its latest Shenxing Battery in Germany and Hungary