EV sales generally surprised to the upside in August as new product cycles continue to garner robust demand, according to Edison Yu’s team.

China’s major electric vehicle (EV) makers have reported August sales in recent days, and as usual, Deutsche Bank analyst Edison Yu’s team shared their thoughts.

EV sales generally surprised to the upside in August as the new product cycle continues to garner robust demand, the team said in a research note sent to investors today.

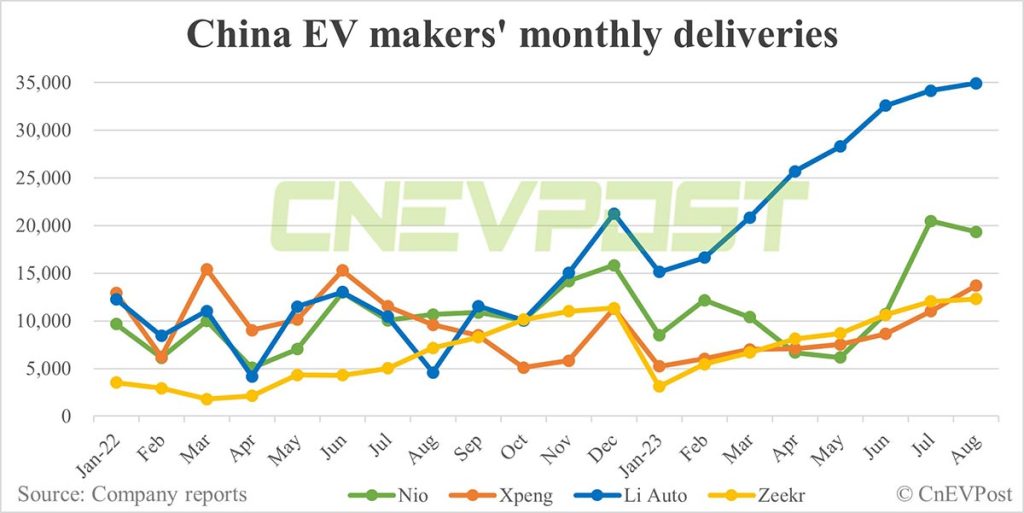

Li Auto set a new record, while Nio saw some sequential weakness, albeit performing better than expected, the note said, adding that Xpeng continues to ramp up the new G6, which appears on track for 10,000 units per month soon.

“Looking ahead, we continue to expect much better 2H volume from NIO/XPEV while Li Auto could be in a more defensive position as competition intensifies,” the team wrote.

As a backdrop, Nio delivered 19,329 vehicles in August, the second highest on record. This was up 81.03 percent year-on-year, but down 5.54 percent from July.

Xpeng delivered 13,690 vehicles in August, its highest since June 2022 when it delivered 15,295 vehicles. The August delivery was up 42.93 percent year-on-year and up 24.36 percent from July, marking the seventh consecutive month of consecutive growth.

Li Auto delivered 34,914 vehicles in August, up 2.29 percent from July and up 663.82 percent year-on-year.

Here’s what Yu’s team had to say about August deliveries for four of China’s emerging EV companies.

August OEM recap

Li Auto delivered 34,914 vehicles (+2% MoM; +664% YoY), ahead of our forecast. All three models (L7, L8, L9) sold over 10,000 units. The L9 has maintained top selling spot in the full-size SUV segment for 12 straight months.

Looking ahead, we expect competition to further intensify from other OEMs, potentially limiting incremental growth until the new cheaper L5 starts deliveries next year. The company exited the month with 346 retail stores and 324 servicing centers.

NIO delivered 19,329 units (-6% MoM; +81% YoY), coming in better than feared. Vehicle mix was 62% SUV vs. 38% sedan. Management’s 3Q guidance implies a further decease in Sep to around 15,000-17,000 units, suggesting the order book has weakened somewhat.

Beyond that, the revamped larger sales structure should be built out by the end of Sep which should boost 4Q sales; the new EC6 should also officially launch in the coming weeks. NIO exited the month with >1,700 battery swap stations.

XPeng delivered 13,690 units (+24% MoM; +34% YoY), in-line with our expectations. G6 is ramping up well reaching 7,068 deliveries, up from July’s 3,937, still seeing some supply constraints on the higher end MAX trim.

Looking ahead, we expect Sep can reach 15,000 total deliveries and reach/beat high-end of 3Q guidance (41,000).

In relation, the higher than expected pricing of Tesla‘s revamped Model 3 (~260k RMB vs. 200k) may also alleviate some fears of P7i demand dropping off.

Zeekr delivered sales of 12,303 vehicles (+2% MoM; +72% YoY). Separately, the 001 FR was officially unveiled with production limited to 99 per month, designed to be the ultra high performance halo version. Deliveries begin late next month, promising 0-100 kph in 2.07 seconds and top speed of 280 kph.

Nio delivers 19,329 vehicles in Aug, down from Jul but 2nd-highest on record