Xpeng saw insurance registrations of 3,100 units last week, down 6.06 percent from 3,300 units in the previous week. BYD saw registrations of 50,800 units last week, down 1.74 percent from the previous week.

Most of China’s major electric vehicle (EV) makers saw a decline in insurance registrations last week, as deliveries at the start of the month are usually flat.

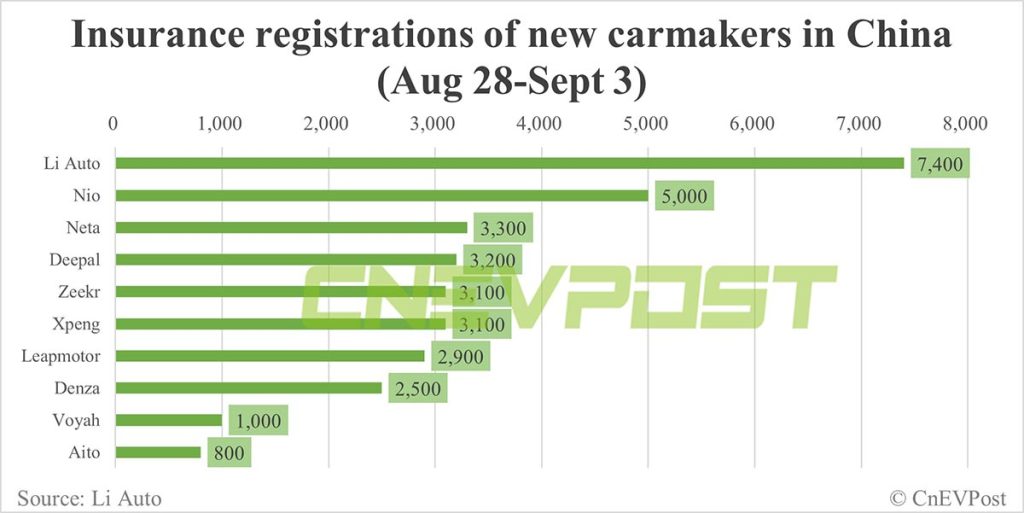

For the week of August 28 to September 3, Li Auto (NASDAQ: LI) continued to top the list of China’s new car makers with sales of 7,400 units, the company said today on Weibo.

As before, Li Auto didn’t explain the basis for calculating the weekly sales, but apparently, they were insurance registrations. The company suspended sharing those numbers in May, but has since resumed sharing them.

Li Auto’s insurance registrations were down 3.9 percent last week compared to the previous week’s 7,700 units.

Li Auto continues to suffer from capacity constraints. Li Xiang, the company’s founder, chairman and CEO, said last month that parts capacity bottlenecks would be resolved in October.

Li Auto’s plant in Changzhou, Jiangsu province, will be upgraded during China’s National Day holiday to support the expansion, he said earlier this month.

Nio (NYSE: NIO) had insurance registrations of 5,000 units last week, unchanged from the previous week.

The wait time for Nio’s flagship SUV, the ES8, in China has gotten slightly shorter, going from 8-9 weeks previously to 6-7 weeks, a September 1 update from the Nio App showed.

Nio will launch the new EC6 on September 15 and will start deliveries soon, a Weibo user quoted the EV maker’s co-founder and president Qin Lihong as saying at a partner conference yesterday.

Xpeng (NYSE: XPEV) delivered 3,100 units last week, down 6.06 percent from 3,300 units the week before.

Xpeng delivered 13,690 vehicles in August, with the G6 contributing 7,068, according to figures it announced on September 1.

Due to the company’s preparation and efficiency throughout the supply chain as well as its manufacturing and delivery capabilities, the G6 achieved a significant increase in production, Xpeng said on September 1.

Xpeng officially launched the G6 in China on June 29, with deliveries beginning July 10.

Tesla (NASDAQ: TSLA) was at 11,800 last week, down 30.59 percent from 17,000 the week before.

Tesla cut the price of both the Model Y Long Range as well as the Model Y Performance in China by 14,000 yuan ($1,930), or about 4 percent, on August 14. The entry-level Model Y was unchanged at the time.

Tesla unexpectedly began pre-sales of the revamped Model 3 in China on September 1, and then had the model unveiled at the China International Fair For Trade in Services, which is being held in Beijing.

BYD sold 50,800 units last week, down 1.74 percent from 51,700 units the week before.

BYD sold 274,386 NEVs in August, a new record high, according to a September 1 announcement.

Denza, BYD’s premium brand, was at 2,500 units last week, up 8.7 percent from 2,300 the week before.

Neta was at 3,300 units last week, up 43.48 percent from 2,300 the week before.

Zeekr was 3,100 last week, the same as the previous week.

Leapmotor was at 2,900 last week, down 6.45 percent from 3,100 the week before.