Between September 1 and September 24, Nio was at 13,900 units, Xpeng at 10,400 units, Li Auto at 29,200 units, Tesla at 35,900 units and BYD at 176,200 units.

Most of the major electric vehicle (EV) makers saw a rise in insurance registrations in China last week, with Tesla’s growth especially notable.

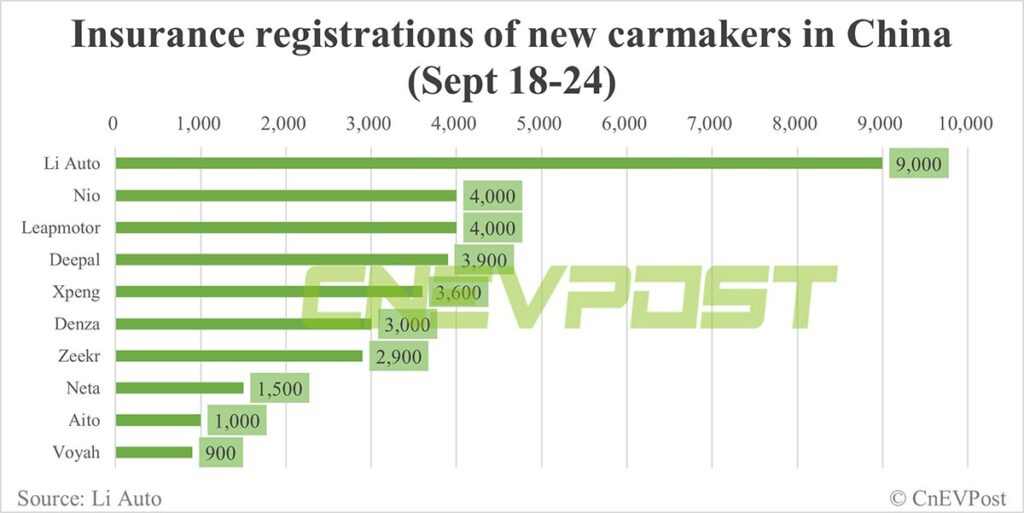

For the week of September 18 to September 24, Li Auto (NASDAQ: LI) sold 9,000 vehicles, ranking No. 1 among China’s new car makers, the company said today on Weibo.

As before, Li Auto didn’t explain the basis for calculating the weekly sales, but apparently, they were insurance registrations. The company suspended sharing that data in May, but has since resumed sharing it.

Li Auto’s insurance registrations last week were down 1.1 percent from the previous week’s 9,100 as it continues to face production capacity bottlenecks.

To avoid the potential logistical impact of the Hangzhou Asian Games, Li Auto and its suppliers have been producing without weekend breaks for the last two weeks, Li Xiang, the company’s founder, chairman, and CEO, said in a Weibo post last Tuesday, adding that the rise in weekly deliveries was not an expansion of production.

Li Auto will stop production to upgrade the factory at the end of September and during the National Day holiday, and all production lines will be upgraded to double-shift production, he said at the time.

As of September 24, Li Auto had 29,200 insurance registrations in September, according to the company.

Li Auto previously guided for vehicle deliveries to be between 100,000 and 103,000 in the third quarter. Considering it delivered 69,048 vehicles in July and August, the company is on track to deliver between 30,952 and 33,952 vehicles in September.

Li Auto’s 500,000th mass-produced vehicle rolled off the assembly line yesterday and the company is close to completing its 500,000th delivery, it said.

Nio (NYSE: NIO) vehicles had 4,000 insurance registrations in China last week, up 2.56 percent from 3,900 the week before.

As of September 24, Nio had 13,900 insurance registrations in September.

Nio had previously guided for third-quarter deliveries of 55,000 to 57,000 units, implying that it was on track to deliver 15,209 to 17,209 vehicles in September, considering that it delivered 20,462 in July and 19,329 in August.

Nio launched the new EC6 on September 15, completing the transition of all NT 1.0-based models to the latest NT 2.0 platform. Deliveries of the model began on the night of the launch.

Xpeng (NYSE: XPEV) was at 3,600 units last week, unchanged from the previous week.

Between September 1 and September 24, a total of 10,400 Xpeng vehicles were registered for insurance in China.

Xpeng delivered 11,008 and 13,690 vehicles in July and August, respectively. The company previously guided for deliveries of between 39,000 and 41,000 vehicles in the third quarter, meaning it is on track to deliver between 14,302 and 16,302 vehicles in September.

Xpeng launched the new G9 on September 19 at a starting price of 263,900 Chinese yuan ($36,100), which is 46,000 Chinese yuan lower than the 309,900 Chinese yuan of the old model.

The new G9 received more than 8,000 firm orders within 72 hours of launch, Xpeng announced on September 23 on its social media channels.

Deliveries of the new G9 began on September 21, Xpeng said.

On September 25, Xpeng launched the new P5 sedan, removing the LiDAR option for the model and cutting the number of versions to just two.

Tesla (NASDAQ: TSLA) vehicles saw 13,500 insurance registrations in China last week, up 58.82 percent from 8,500 the week before.

From September 1 to September 24, a total of 35,900 Tesla vehicles were registered for insurance in China.

On September 1, Tesla began pre-sales of the revamped Model 3 in China. The model has not yet been officially sold in China and deliveries are expected to begin in the fourth quarter, according to its website.

On September 17, Tesla said it saw its 5 millionth vehicle roll off the line since its inception. The vehicle, a white, updated Model 3 sedan, rolled off the line at Giga Shanghai.

BYD vehicles saw 61,700 insurance registrations in China last week, up 20.74 percent from 51,100 the previous week.

Between September 1 and September 24, BYD’s figure stood at 176,200 units.

BYD’s premium brand Denza was at 3,000 units last week, up 20 percent from 2,500 units in the previous week. Between September 1 and September 24, Denza had the figure at 8,800 units.

Neta was at 1,500 units last week, down 25 percent from 2,000 the week before. Between September 1 and September 24, Neta had 5,400 insured registrations in China.

Zeekr was 2,900 units in the last week, up 20.83 percent from 2,400 in the previous week. Between September 1 and September 24, Zeekr had that figure at 8,200 units.

Leapmotor was at 4,000 units last week, up 17.65 percent from 3,400 the week before. For the period September 1 through September 24, Leapmotor had that figure at 11,100 units.

(1 US dollar = 7.3108 Chinese yuan)