Most of the major EV makers saw insurance registrations fall last week, as the beginning of the month is usually a low point for deliveries.

Most major electric vehicle (EV) makers saw insurance registrations decline last week, as the beginning of the month is usually a low point for deliveries.

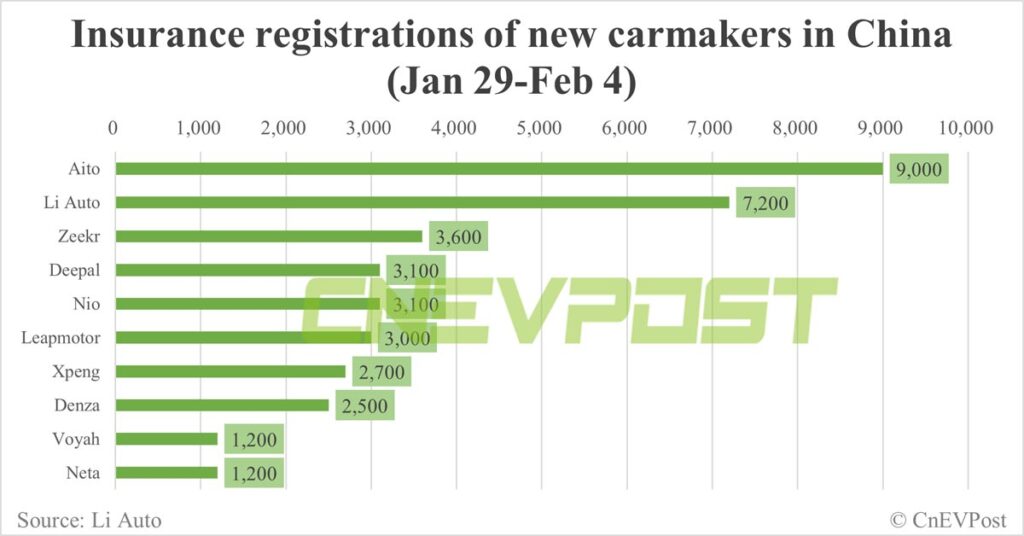

For the week of January 29 to February 4, Li Auto (NASDAQ: LI) had weekly sales of 7,200 units, the second-highest among China’s new car makers, the company said today on Weibo.

As before, Li Auto didn’t explain the basis for calculating those weekly sales, but apparently, they were insurance registrations. The company suspended sharing this data in May 2023, but has since resumed sharing it.

Li Auto’s insurance registrations last week were down 15.29 percent from the previous week’s 8,500 units, re-surpassed by the Huawei-backed Aito’s 9,000 units.

Li Auto’s insurance registrations were higher than Aito’s in both the week of January 15-21 and the week of January 22-28, but were lower in both of the first two weeks of January.

Li Auto delivered 31,165 vehicles in January, up 105.83 percent year-on-year but 38.11 percent lower than December, according to data it released on February 1.

January, and the month in which the Chinese New Year holiday falls, is usually a low point for auto sales in China. The 2024 Chinese Lunar New Year holiday runs from February 10 to February 17. Last year the holiday was January 21-27, 2023.

Aito delivered a record 32,973 vehicles in January, up 636.83 percent year-on-year and up 34.76 percent from December.

Nio (NYSE: NIO) had 3,100 insurance registrations in China last week, down 6.06 percent from 3,300 the week before.

Nio delivered 10,055 vehicles in January, up 18.21 percent from 8,506 a year ago, but down 44.18 percent from 18,012 in December.

The company announced on January 17 that it will begin deliveries of its 2024 models in early March and begin offering incentives on current models.

Xpeng (NYSE: XPEV) had 2,700 insured registrations last week, up 22.73 percent from 2,200 the week before, and was one of the few to see an uptick.

Xpeng delivered 8,250 vehicles in January, up 58.11 percent year-on-year but down 58.99 percent from December.

Xpeng announced on January 26 that it started an upgrade project at its Zhaoqing plant in Guangdong province, which will last about 20 days, with overall production line commissioning to be completed by the end of February.

The upgrade is intended to prepare for the launch of new models and increase the plant’s capacity, Xpeng said. The company also has another plant in Guangzhou, Guangdong province, where it is headquartered.

Xpeng offered limited-time discounts on several models earlier this month.

Insurance registrations for Tesla (NASDAQ: TSLA) vehicles in China last week amounted to 10,600, down 17.19 percent from 12,800 the week before.

Tesla sold 71,447 China-made vehicles in January, up 8.17 percent from 66,051 a year earlier but down 24.10 percent from 94,139 in December, according to the China Passenger Car Association (CPCA).

The sales include those sold in China as well as those exported to overseas markets from the Shanghai plant. The breakdown figures are not yet available.

Tesla began the Cybertruck’s tour of China on January 28, unveiling it in its first eight cities. The electric pickup may not be available in China anytime soon, but has brought Tesla a significant increase in store visits.

Tesla has a factory in Shanghai that produces the Model 3 sedan and Model Y crossover, and with a current annual production capacity of more than 950,000 vehicles.

Tesla cut the prices of the Model 3 and Model Y in China on January 12.

On February 1, Tesla launched the upgraded Model Y in China, upgrading the self-driving computer to Hardware 4.0 (HW 4.0) but leaving the price unchanged. For customers ordering select versions of the Model Y that have already been produced, there is a RMB 8,000 ($1,110) cash discount.

BYD (OTCMKTS: BYDDF) had 43,300 insurance registrations in China last week, unchanged from the previous week.

BYD sold 201,493 new energy vehicles (NEVs) in January, up 33.14 percent year-on-year but down 40.92 percent from December.

BYD’s premium brand Denza was at 2,500 units last week, up 8.7 percent from 2,300 units in the previous week.

Denza sold 9,068 units in January, up 98.75 percent but down 23.98 percent from December.

Zeekr was at 3,600 units last week, up 16.13 percent from 3,100 units the week before.

Leapmotor was at 3,000 units last week, up 11.11 percent from 2,700 the week before.

Neta was at 1,200 units last week, down 29.41 percent from 1,700 the week before.

($1 = RMB 7.1895)