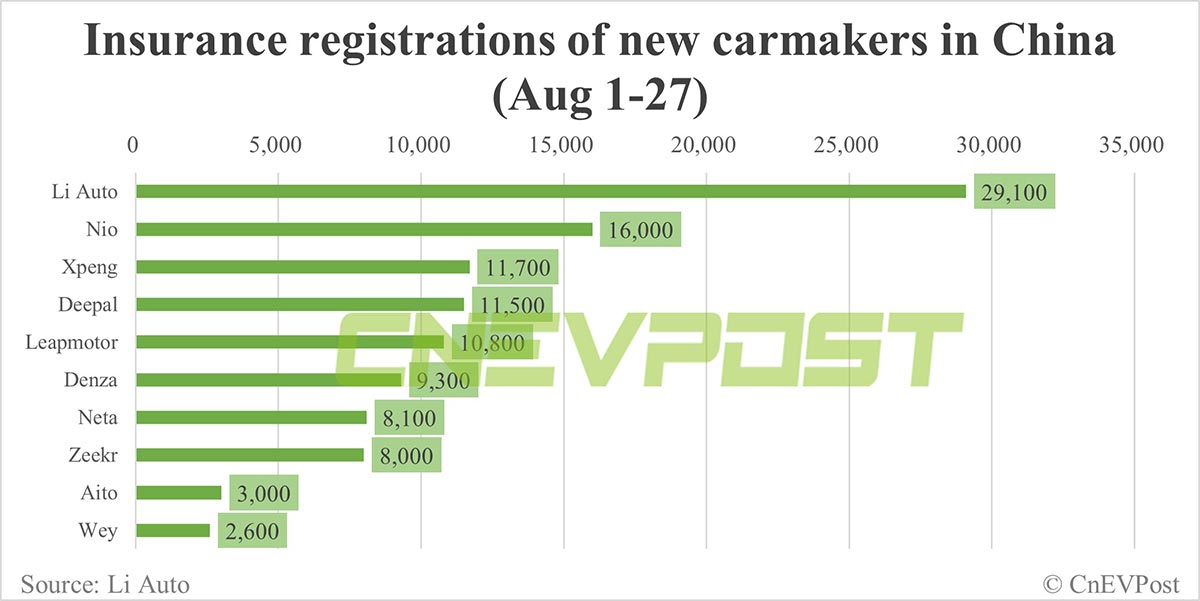

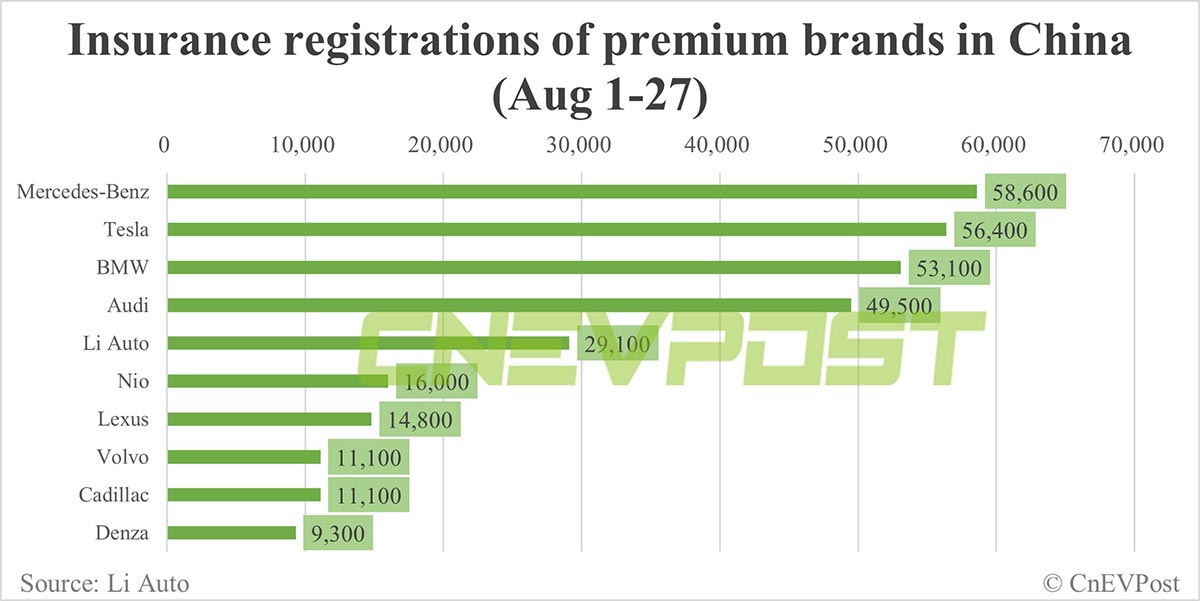

Between August 1 and August 27, Nio vehicles saw 16,000 insurance registrations in China, Xpeng at 11,700, Li Auto at 29,100 and Tesla at 56,400 units.

Insurance registrations in China by major electric vehicle (EV) makers were mostly higher last week, the latest figures show.

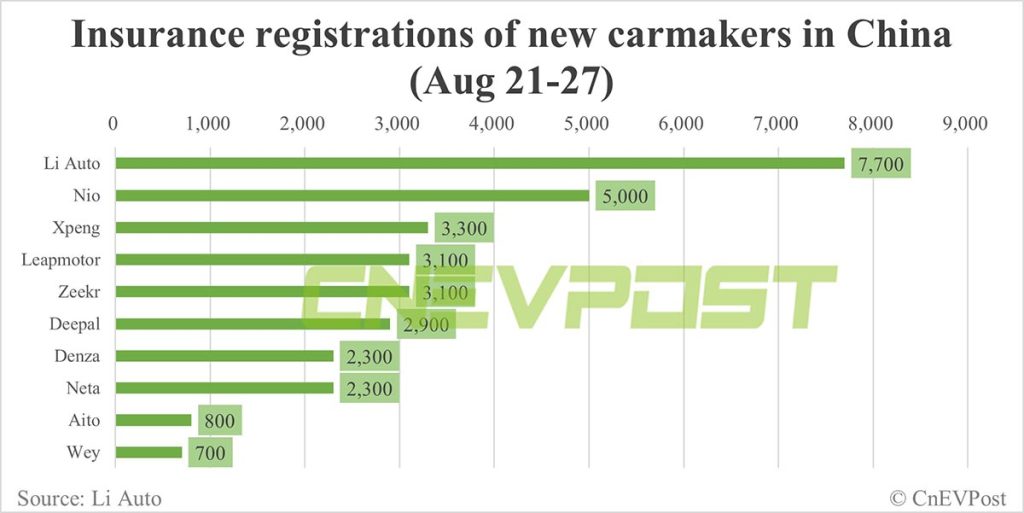

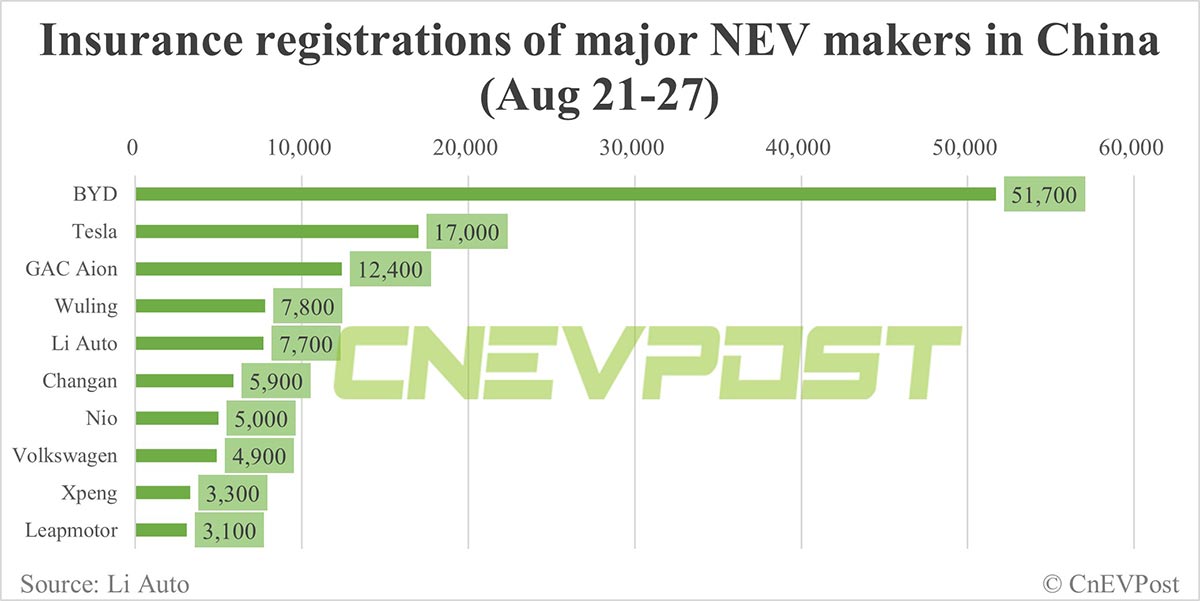

For the week of August 21 to August 27, Li Auto (NASDAQ: LI) continued to top the list of China’s new car makers with 7,700 units sold, the company said today on Weibo.

As before, Li Auto didn’t explain the basis for calculating that weekly sales volume, but apparently they were insurance registrations. The company suspended sharing that data in May, but has since resumed sharing it.

Li Auto’s insurance registrations were down 3.75 percent last week from 8,000 the week before. Between August 1 and August 27, insurance registrations for Li Auto vehicles were 29,100 units.

Li Auto continues to be hampered by capacity constraints, and Li Xiang, the company’s founder, chairman and CEO, said earlier this month that parts capacity bottlenecks will be resolved in October.

Li Auto’s plant in Changzhou, Jiangsu province, will be upgraded and remodeled during China’s National Day holiday to support the expansion, he said.

Nio (NYSE: NIO) had 5,000 insurance registrations last week, up 21.95 percent from 4,100 the previous week.

Between August 1 and August 27, there were 16,000 insurance registrations for Nio vehicles in China.

Nio is currently seeing at least 300 ES6s roll off the production line every day, and some of its workshops have switched from single-shift to two-shift production, local media outlet Caixin said in an August 21 report, citing a source familiar with the company’s production lines.

In addition, Nio’s F1 plant stopped production for five days between July 29 and August 2 to undergo a production line upgrade, according to the report.

Nio cut the starting prices of all new models by RMB 30,000 ($4,120) on June 12, while making the previously free battery swap service a paid option.

Following the move, Nio’s order inflow saw a meaningful surge in July, but has slowed so far in August, Morgan Stanley analyst Tim Hsiao’s team said in an August 23 research note.

On the bright side, however, Nio’s order momentum gradually picked up again from mid-August, the team said.

Xpeng (NYSE: XPEV) was at 3,300 vehicles last week, up 3.13 percent from 3,200 in the previous week. Between August 1 and August 27, Xpeng had that figure at 11,700 units.

That modest weekly increase means that capacity creep for Xpeng’s new SUV, the G6, remains slow.

Xpeng officially launched the G6 in China on June 29, with deliveries starting on July 10.

Xpeng was working with suppliers to increase production capacity and expects G6 deliveries to ramp up significantly in September, pushing the company’s monthly deliveries to more than 15,000 units, its management said in an August 18 analyst call after announcing second-quarter earnings.

Xpeng will challenge the target of 20,000 monthly deliveries in the fourth quarter and get the G6 to deliver more than 10,000 units in a single month, the company said.

Tesla (NASDAQ: TSLA) had 17,000 insurance registrations in China last week, up 22.30 percent from 13,900 units in the previous week.

Between August 1 and August 27, 56,400 Tesla vehicles were registered for insurance in China.

Tesla has a factory in Shanghai that produces the Model 3 and Model Y.

On August 14, Tesla lowered the prices of two versions of the Model Y in China and began offering insurance subsidies for Model 3 inventory vehicles.

On August 16, local media China Securities Journal cited a person familiar with the matter as saying that Tesla’s revamped Model 3 sedan is expected to go on sale in China within half a month. However, this has so far not become a reality.

Some of Tesla’s stores have already started accepting pre-orders for the improved Model 3 from Chinese customers, the report said.

It’s also worth noting that Tesla’s pattern is to produce cars for export in the first half of the quarter and for the local market in the second half, the company previously said.

BYD (OTCMKTS: BYDDY) saw 51,700 insurance registrations in China last week, up 7.04 percent from 48,300 in the previous week.

Between August 1 and August 27, BYD vehicles had 179,300 insurance registrations in China.

BYD’s premium brand Denza was at 2,300 units last week, down 4.17 percent from 2,400 units the week before. Between August 1 and August 27, Denza had 9,300 insurance registrations.

Denza launched its new SUV Denza N8 on August 5, and the brand said on August 22 that the deliveries of the model had begun.

The first model of the re-branded Denza was the D9, an MPV launched in August 2022 and deliveries started in October last year. Denza’s second model, the N7, was launched on July 3 and deliveries began on July 31.

Production of the Denza N7 has been accelerated and deliveries have exceeded 1,000 units this month, the brand’s chief Zhao Changjiang said on August 22.

Geely‘s premium EV brand Zeekr had 3,100 insurance registrations last week, up 106.67 percent from 1,500 the week before.

Between August 1 and August 27, Zeekr had 8,000 insurance registrations.

On August 11, Zeekr announced that customers who buy the Zeekr 001 during the year would receive a discount of between RMB 30,000 and RMB 37,000, which lowered the starting price of the model to RMB 269,000

On August 15, Zeekr extended the opening hours of its 11 comprehensive stores in 10 cities until 11:00 pm to capitalize on consumer enthusiasm in the early stages of the price cut.

Neta Auto had 2,300 insurance registrations last week, up 15 percent from 2,000 the week before. Between August 1 and August 27, Neta’s insurance registrations stood at 8,100 units.

Neta launched the Neta Aya on August 3 to replace its predecessor, the Neta V, but at a significantly lower starting price.

Leapmotor registered 3,100 insurance registrations last week, up 6.9 percent from 2,900 the previous week. Between August 1 and August 27, Leapmotor had 10,800 insurance registrations.

Bloomberg reported on August 23 that Stellantis NV, Europe’s second-largest automaker by sales, was considering a partnership with a Chinese EV company to bolster its position in the Chinese market.

Stellantis has explored the possibility of partnering with Chinese EV makers, including Leapmotor, according to the report.

($1 = RMB 7.2905)