StarCharge is considering an IPO in Hong Kong, potentially raising about $500 million and seeking a $5 billion valuation, according to Bloomberg.

StarCharge, a Chinese operator of electric vehicle (EV) charging piles and maker of charging equipment, is considering an initial public offering (IPO) in Hong Kong that could raise about $500 million, Bloomberg said in a report today, citing people familiar with the matter.

The company, registered as Wanbang Digital Energy Co, is working with China International Capital Corp and China Merchants Bank International on an initial share sale that could take place as early as this year, according to the report.

StarCharge may seek a $5 billion valuation at the time of the IPO, the person familiar with the matter said, adding that deliberations are still ongoing and that details of the IPO, including the size, are subject to change.

StarCharge, based in Changzhou, Jiangsu province in eastern China, was founded in 2014. Its last round of funding was a Series B round in May 2021 from investors including Hillhouse Capital and IDG, according to its website.

The company did not mention the amount it raised at the time, but said it had a post-investment valuation of RMB 15.5 billion ($2.2 billion), making it a leading unicorn in Asia’s digital energy sector.

A unicorn company is usually defined as one that is no more than 10 years old and has a valuation of more than $1 billion.

StarCharge raised nearly 1.5 billion yuan in the Series B round of financing, Bloomberg said in the report today, citing a statement from a law firm that advised on the deal.

StarCharge is one of the companies with the largest number of public charging piles in China, with facilities in residential areas and shopping malls.

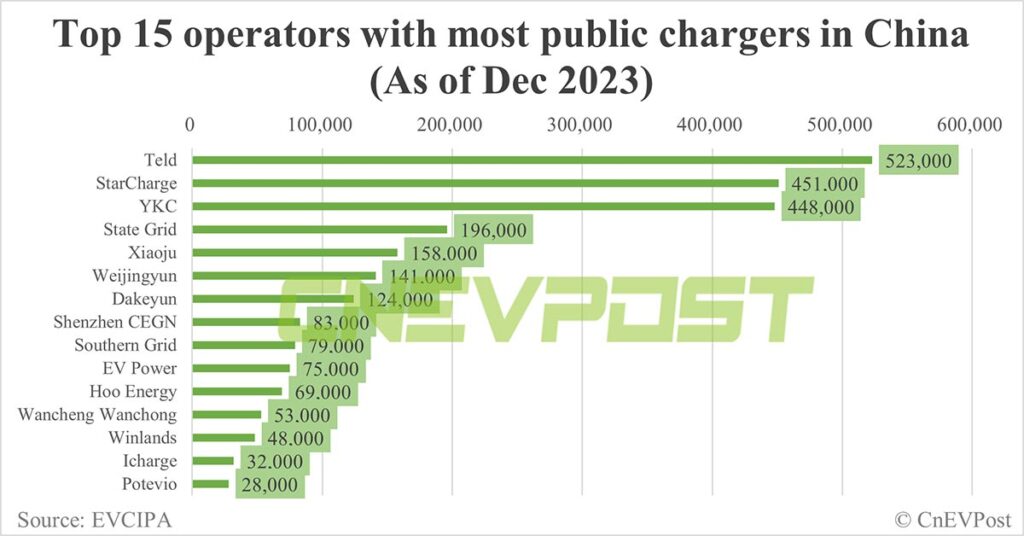

As of the end of December 2023, StarCharge had 451,000 public charging piles in China, ranking second behind Teld’s 523,000 units, according to China Electric Vehicle Charging Infrastructure Promotion Alliance (EVCIPA).

StarCharge is one of the charging equipment providers that have emerged with the rapid growth of the new energy vehicle (NEV) industry in China.

By the end of 2023, China’s NEV ownership reached 20.41 million, accounting for 6.07 percent of the total vehicle ownership of 336 million vehicles, according to data released on January 11 by China’s Ministry of Public Security.

By the end of 2023, China’s battery electric vehicle (BEV) holdings stood at 15.52 million units, accounting for 76.04 percent of all NEVs.

($1 = RMB 7.1622)