Nio CEO William Li told CnEVPost last month that every RMB 50,000 drop in the price of lithium carbonate would result in roughly a 1.5 percent improvement in gross margin for the company.

Chinese power battery giant CATL is rumored to have lowered the price of batteries it supplies to Nio and Zeekr, as the price of lithium carbonate, a key raw material for batteries, continues to fall.

A research note by local Chinese brokerage Tianfeng Securities, which lowered their forecast for CATL’s earnings in the third quarter, circulated in Chinese media as well as on social media yesterday.

Subsequently, several auto bloggers on Weibo said that this could be due to CATL’s price concessions to two key customers, Nio and Zeekr, which could contribute 2 percentage points to Nio’s gross margin in the third quarter.

CATL’s move may also be telling other carmakers that battery prices are negotiable and will continue to fall, a Weibo blogger with more than 100,000 followers wrote yesterday.

Earlier yesterday, several local media reported that Tianfeng Securities lowered their forecast for CATL’s third-quarter profit to RMB 11 billion ($1.58 billion) from RMB 11.5 billion previously.

CATL had been gradually negotiating rebate programs with customers for next year in the third quarter, so it took early accruals for that, according to the note.

The new decline in lithium carbonate prices, which has lasted for months, may be one of the key reasons for CATL’s rumored move.

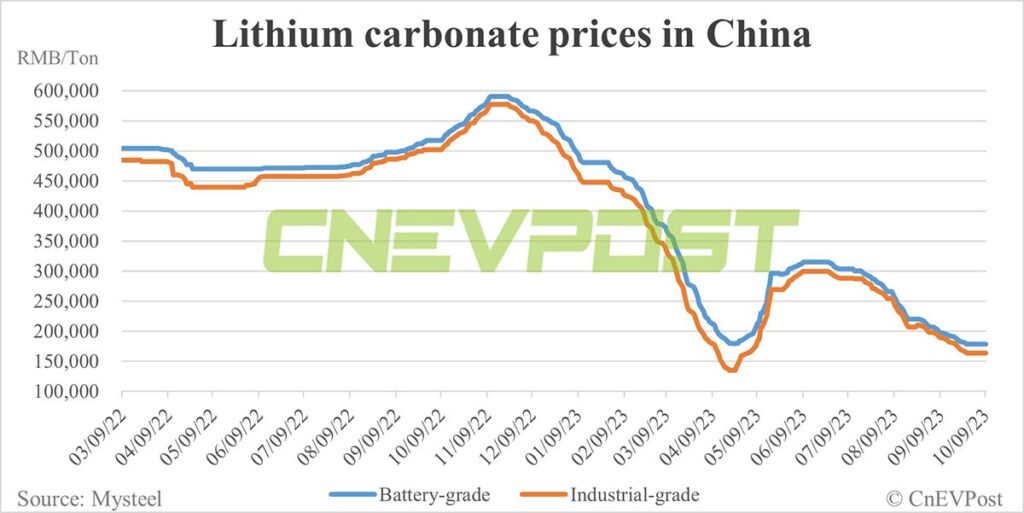

On November 23, 2022, the price of battery-grade lithium carbonate in China rose to RMB 590,000 per ton, up about 14 times from RMB 41,000 per ton in June 2020.

However, going into 2023, factors including weak demand for electric vehicles (EVs) caused lithium carbonate prices to decline.

From the beginning of the year through April 21, battery-grade lithium carbonate prices fell about 65 percent in China, according to data from Mysteel.

After seeing a brief rebound in June, battery-grade lithium carbonate prices have resumed their downward trend since July and are currently quoted at RMB 178,500 per ton, down about 41 percent from RMB 304,000 per ton in early July.

The previous surge in lithium carbonate prices has put pressure on EV makers’ earnings, as the battery pack is one of the most expensive parts of an EV, and in some cases can account for 30 to 40 percent of the cost of the entire vehicle.

Nio (NYSE: NIO) founder, chairman, and CEO William Li said in an analyst call after the company announced its earnings on November 10, 2022, that every RMB 100,000 increase in the price of lithium carbonate will negatively impact Nio’s gross margins by 2 percentage points.

On September 21, CnEVPost asked Li the following question in an interview following Nio’s Nio In 2023 innovation day event:

The price of lithium carbonate has been falling for three months now, to less than RMB 200,000 per ton, how does this affect Nio’s gross margin?

Li said at the time that every RMB 50,000 drop in the price of lithium carbonate would result in roughly a 1.5 percent improvement in Nio’s gross margin.

Nio is pleased to see lithium carbonate prices returning to rationality and sees further room for them to fall, Li told CnEVPost at the time.

For Nio, lower battery costs are what it needs to improve its financial position.

Nio’s gross margin fell further to 1.0 percent in the second quarter from 1.5 percent in the first quarter, lower than 13.0 percent a year earlier.

The company’s vehicle margin was 6.2 percent in the second quarter, down from 16.7 percent in the same period last year, and an improvement from 5.1 percent in the first quarter, according to its second-quarter earnings report.

The decline in vehicle margins compared with the second quarter of 2022 was primarily attributable to changes in product mix, partially offset by lower unit battery costs, Nio said in the earnings report.

($1 = RMB 7.2923)

Analysts explain how falling lithium carbonate prices affect EV costs