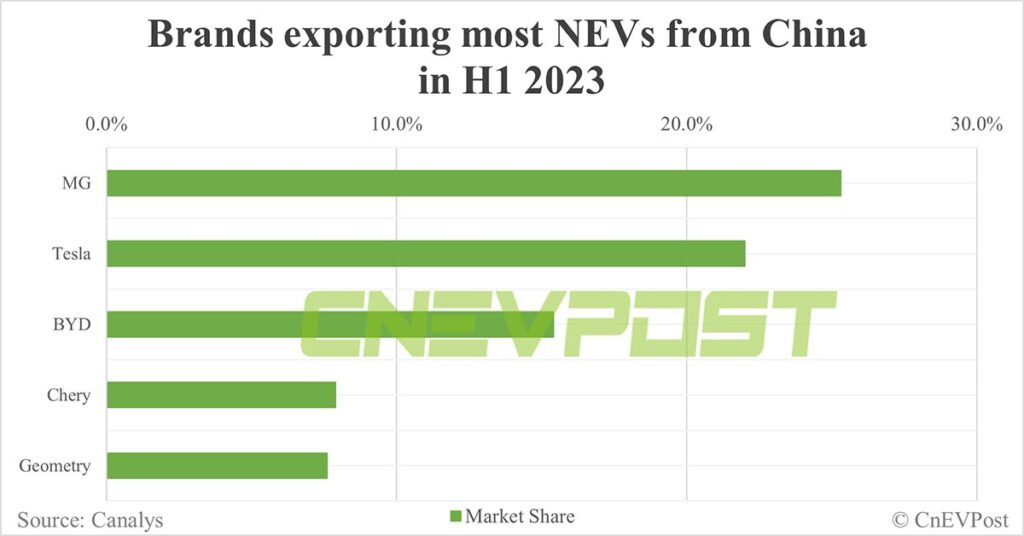

MG, Tesla, and BYD were the brands that exported the most NEVs from China in the first half of the year, contributing 25.3 percent, 22 percent, and 15.4 percent, respectively.

China’s auto exports are expected to reach 5.4 million units in 2023, of which new energy vehicles (NEVs) will contribute 40 percent, or 2.2 million units, market researcher Canalys said in a report today.

That’s a significant upward revision from Canalys’ forecast in June, when the firm predicted that China’s auto exports were expected to reach 4.4 million units in 2023, with more than 30 percent of those being NEVs.

In the first half of the year, China exported 2.3 million vehicles, making it the world’s top auto exporter, Canalys’ latest report noted.

In the second half of the year, China’s auto exports will continue to gain momentum, with annual exports expected to be the world’s No. 1, Canalys said.

This is due to product and technology advantages, increased investment in channels, research and development, and product localization, Canalys said, adding that NEVs will continue to be a major part of China’s auto export growth.

Changes in subsidy policies for imported NEVs in some regions and markets may temporarily affect the advantage of Chinese carmakers, said Canalys analyst Liu Ceyuan.

Some European countries have adopted new rules to assess whether NEVs are eligible for subsidies, which could result in NEVs imported from China not meeting the standards and thus losing their price advantage, Liu said.

However, while the subsidy policy changes will have an impact on Chinese car companies in the short term, the window for Chinese car companies to explore overseas markets still exists, given strong demand in overseas markets and the continued optimization of the global NEV portfolio, the analyst said.

Canalys said that more joint-venture car companies continue to raise their export targets, which will allow more overseas consumers to experience China-made products, improve overseas market recognition of the quality and production processes of Chinese automotive products, and help the global expansion of Chinese car companies.

Canalys expects China’s auto exports to reach 7.9 million in 2025, of which the proportion of NEVs will exceed 50 percent.

Compared with traditional fuel vehicles, Chinese brands of NEVs have performed better, especially in Southeast Asia as well as in the Middle East African market, where the market share of Chinese brands of NEVs has reached 71 percent and 63 percent, respectively, according to the report.

BYD is the best-selling NEV brand in Southeast Asia, with a 39.8 percent market share in the region.

Notably, BYD is the only brand with a market share of more than 10 percent in the NEV market, Canalys said.

More than 30 automotive brands currently export automotive products to regions outside the Chinese mainland, with the top five brands capturing a total of 42.3 percent market share in the first half of 2023, Canalys noted.

Tesla is the only foreign auto brand among the top five exporters, contributing 5.1 percent of China’s light-duty vehicle exports in the first half of this year, as well as 22 percent of NEV exports.

For light-duty vehicles, Chery was the top exporting brand in the first half of the year, with a 14.9 percent share, while SAIC’s MG brand came in second with a 13.2 percent share.

For NEV exports, MG ranked first in the first half with a 25.3 percent share, with Tesla in second place and BYD in third with 15.4 percent.

In the first half of the year, BYD’s NEVs overseas amounted to 74,000 units, dominated by pure electric models, which accounted for 93 percent of total exports, according to Canalys.

Southeast Asia is BYD’s largest overseas market, contributing 43 percent of BYD’s overseas sales in the first half of the year.

As BYD’s overseas product line becomes richer, its models are expected to replace Japanese small cars, thus expanding its market share in Southeast Asia, Canalys said.

China exports 2.34 million vehicles in H1, NEVs contribute 34%