The number of shares BYD plans to buy back is about 0.05 percent of its total issued share capital and will be used for cancellation to reduce registered capital.

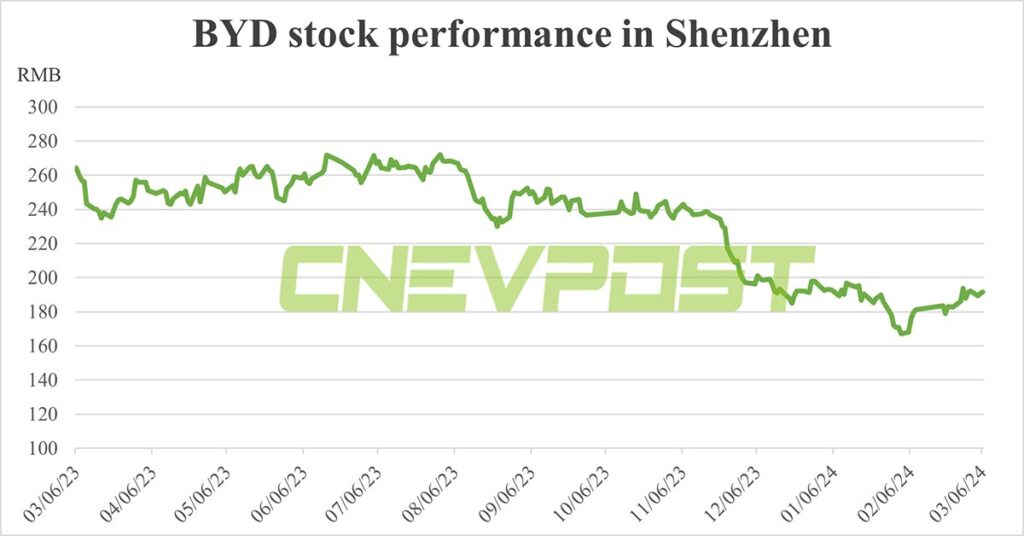

BYD (HKG: 1211, OTCMKTS: BYDDY) will buy back RMB 400 million ($55.6 million) of its shares traded on China’s A-share market, following a significant drop in share price over the past year.

The Shenzhen-listed new energy vehicle (NEV) maker announced the buyback plan in a stock exchange announcement today, saying the buyback price will not exceed RMB 270 per share.

BYD rose 0.43 percent to RMB 191.65 by the close of trading in China’s stock market today.

The company’s shares have risen about 14 percent in the past month, but are still down 27 percent in the past year.

Under the buyback program, BYD expects to repurchase no fewer than 1,481,481 shares, or about 0.05 percent of its current total issued share capital.

The shares that BYD plans to buy back will be used for cancellation to reduce the registered capital, a move that will help better boost investor confidence compared to using the repurchased shares for employee incentives.

To safeguard shareholders’ interests, boost investor confidence, and stabilize and enhance the company’s value, BYD plans to implement a share buyback for cancellation to reduce registered capital, the company said in its announcement.

The buyback will take place over a 12-month period, and BYD will carry out the plan through centralized bidding transactions or other methods approved by China’s securities regulators.

BYD chairman and president Wang Chuanfu proposed on December 6, 2023 that the company repurchase shares traded in Shenzhen for a total amount of RMB 200 million.

The repurchased shares will be used for an employee stock ownership plan, a share incentive program or to reduce registered capital, according to Wang’s proposal at the time.

On February 25, BYD said in a new announcement that it received a new letter from Wang on February 22, in which he proposed that the company increase the amount of planned share buyback to RMB 400 million.

The repurchased shares will be used to reduce the registered capital, according to the February announcement.

BYD saw strong sales growth in 2023, selling 3,024,417 NEVs for the whole year, up 62.3 percent year-on-year.

However, its Shenzhen-traded shares fell 23 percent for the full year 2023, amid China’s macroeconomic challenges. The Shanghai Composite Index fell 3.7 percent in 2023, while the Shenzhen Composite Index lost 13.5 percent.

In January–February, BYD sold 323,804 vehicles, down 6.14 percent year-on-year, according to data compiled by CnEVPost.

BYD’s initial plan for its 2024 sales target is 4 million units, giving a sales forecast of 4.2 million to suppliers, local media outlet 36kr reported on February 26.

BYD has yet to announce its official sales target.

($1 = RMB 7.1994)

BYD refreshes its cheapest model Seagull, lowering prices further