“In light of China’s EV market remaining ultra competitive for the foreseeable future, Xpeng‘s strategy continues to resonate well with us, making the stock our Top Pick in the group,” Deutsche Bank said.

Xpeng (NYSE: XPEV) will report its third-quarter financial results on Wednesday, November 15, before the US markets open, and as usual, Deutsche Bank analyst Edison Yu’s team shared their preview.

“We expect generally in-line results with cautious optimism margins may beat for the first time in a while and more importantly, anticipate a robust 4Q23 outlook after Oct deliveries surprised to the upside,” the team said in a November 7 research note sent to investors.

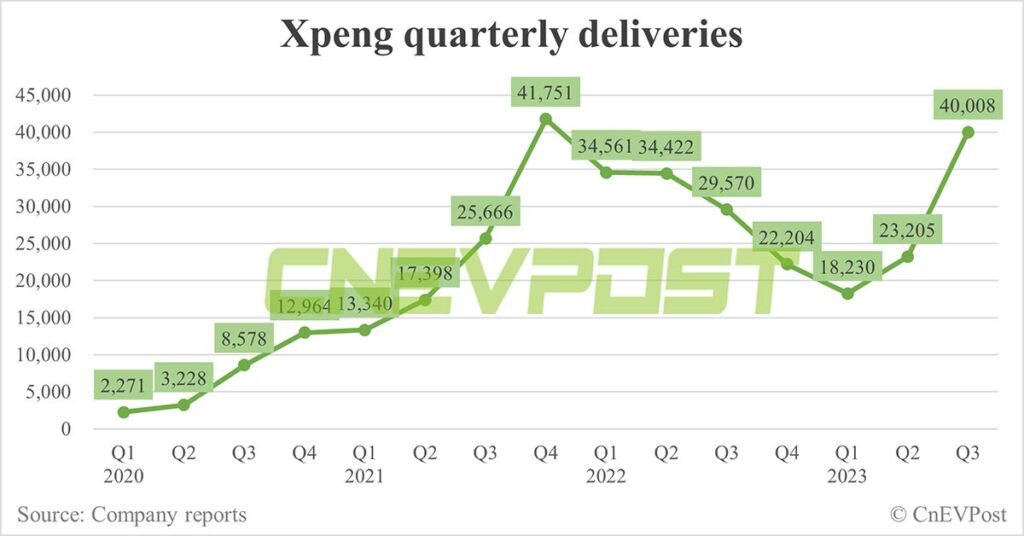

As a background, Xpeng delivered 40,008 vehicles in the third quarter, within the 39,000 to 41,000 range it had previously guided for.

Xpeng had previously guided third-quarter revenue to be in the range of RMB 8.5 billion ($1.17 billion) to RMB 9 billion, up about 24.6 percent to 31.9 percent year-on-year.

Yu’s team expects Xpeng to report revenue of RMB 8.8 billion in the third quarter, with a gross margin of 0.8 percent and adjusted earnings per share of RMB -2.87.

That compares with the current analyst consensus in a Bloomberg survey of RMB 8.6 billion, 3.3 percent and RMB -3.88, respectively, though that may be somewhat stale, the team noted.

Yu’s team expects Xpeng to post a vehicle margin of -1.9 percent in the third quarter, up 6.7 percentage points from a year earlier.

Xpeng’s gross margin was -3.9 percent in the second quarter, a new low since the first quarter of 2020, due to inventory write-downs and loss of inventory purchase commitments related to the G3i.

The company’s vehicle margin was -8.6 percent in the second quarter, compared to 9.1 percent in the same period in 2022 and -2.5 percent in the first quarter.

“With better mix and tailwind from lower battery costs, we believe margin will improve QoQ and could potentially upside,” Yu’s team said.

For the fourth quarter, the team expects Xpeng’s management to likely guide for deliveries of more than 65,000 units, implying full-year deliveries of close to 147,000 units or revenue of more than RMB 32 billion.

Xpeng delivered a record 20,002 vehicles in October, reaching its quarterly peak delivery target two months early, the team noted, adding that G6 sales were 8,741 units and production reached 10,000 units.

This momentum for Xpeng will continue through November and December, supported by strong orders and the launch of the LFP-based P7i, Yu’s team said.

Deliveries of the new model, the X9 MPV, will start in December, but the sales contribution will not be significant, the team said.

Xpeng launched new variants of its flagship sedan, the P7i, on November 6 with lower-cost lithium iron phosphate (LFP) battery packs, bringing the starting price down by RMB 26,000.

The company previously said the X9 will be released at the end of the fourth quarter and may have a limited contribution to this year’s deliveries.

Yu’s team expects Xpeng gross margins to show major improvement in the fourth quarter, as higher volumes and a favorable mix bring vehicle margins back to low-mid single digit, compared to negative in the first half of the year.

For 2024, the team initially believes sales could reach 250,000 units, depending on the timing and contribution of the three new models.

Later yesterday, local media outlet 36kr reported that Xpeng provided the supply chain with a 2024 sales forecast of more than 280,000 units.

An unspoken rule is that car companies usually give high forecasts, while the supply chain will make its own judgment based on the competitiveness of the models and the company’s business performance, the report noted.

Several competing models have been unveiled recently and attracted a lot of media coverage, but Xpeng should be able to compete effectively with those products, Yu’s team said.

“In light of China’s EV market remaining ultra competitive for the foreseeable future, XPeng’s strategy continues to resonate well with us, making the stock our Top Pick in the group,” the team said.

($1 = RMB 7.2799)