Nio‘s SUV deliveries in October were down 3.63 percent from September, while sedan deliveries were up 20.57 percent.

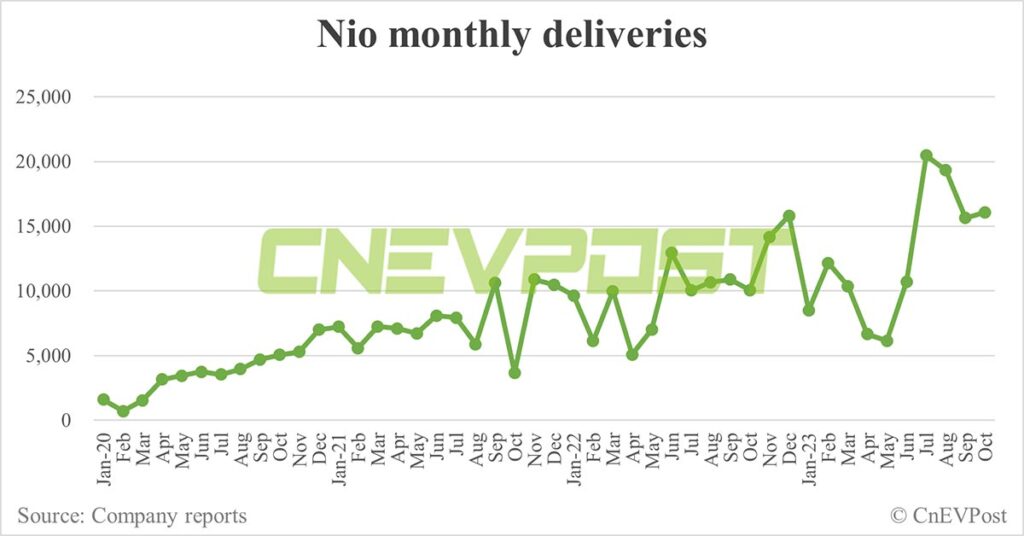

Nio (NYSE: NIO)’s deliveries improved in October from September, though not as much as some of its other local peers.

The electric vehicle (EV) maker delivered 16,074 vehicles in October, up 59.8 percent year-on-year and up 2.77 percent from September, according to data it released today.

The deliveries included 11,086 electric SUVs and 4,988 electric sedans, Nio said.

In the January-October period, Nio delivered 126,067 vehicles, up 36.3 percent year-on-year.

At the end of October, Nio’s cumulative deliveries since inception stood at 415,623 vehicles, data monitored by CnEVPost showed.

Nio currently sells the ES8, ES7, ES6, EC7, EC6, ET7, ET5, and ET5 Touring, the first five of which are SUVs and the last three are sedans.

Deliveries of the company’s SUV models increased 85.35 percent in October from 5,981 a year ago, but decreased 3.63 percent from 11,504 in September.

Deliveries of its sedan models were up 22.25 percent in October from 4,080 a year ago and up 20.57 percent from 4,137 in September.

Nio didn’t release a breakdown of deliveries figures for specific models in October, although the ES6 is likely to remain its top model.

The company delivered 15,641 vehicles in September, with the ES6 contributing 7,896, or 50.48 percent.

The ES6, Nio’s second production vehicle, was initially launched at the Nio Day 2018 event held on December 15, 2018, and it has been Nio’s least expensive SUV.

On May 24, Nio launched the new ES6, which is based on the latest NT 2.0 platform, and began deliveries on the night of its launch. The model now starts at RMB 338,000 ($46,180) in China.

Based on insurance registration numbers, the Nio appears to have delivered around 4,000 units each week for the past two months.

In the last two weeks of October, insurance registrations of Nio vehicles in China were 4,400 and 4,600, respectively, according to figures shared by Li Auto.

Between October 1 and October 29, a total of 14,100 Nio vehicles were registered for insurance in China.

Sales capacity seems to be a major constraint on Nio’s delivery uptake.

Nio realized in June that it was lagging behind its competitors in terms of the number of salespeople it had and its ability to sell, William Li, the company’s founder, chairman, and CEO, said in an August 29 analyst call following the announcement of its second-quarter earnings. The company has not yet announced a release date for its third-quarter earnings.

Nio is expanding its sales team in line with a 30,000-unit-per-month sales capacity, and hopes to initially build that capacity by the end of September and develop that effectiveness initially in October, Li said at the time.

The company added 15 showrooms as well as 124 battery swap stations in October, according to data it released earlier today.

As of October 31, Nio had 139 Nio Houses, 314 Nio Spaces and 2,079 battery swap stations worldwide.

($1 = RMB 7.3196)