While demand for Li Auto‘s vehicles remains robust, investor concerns about competition have increased, particularly around Huawei-backed Aito, said Deutsche Bank analyst Edison Yu’s team.

Li Auto (NASDAQ: LI) will announce its third-quarter financial results before the US markets open on Thursday, November 9, and its management will hold an earnings call on Thursday, November 9, at 7:00 am US Eastern Time (8:00 pm Beijing time).

As usual, Deutsche Bank analyst Edison Yu’s team has shared their earnings preview.

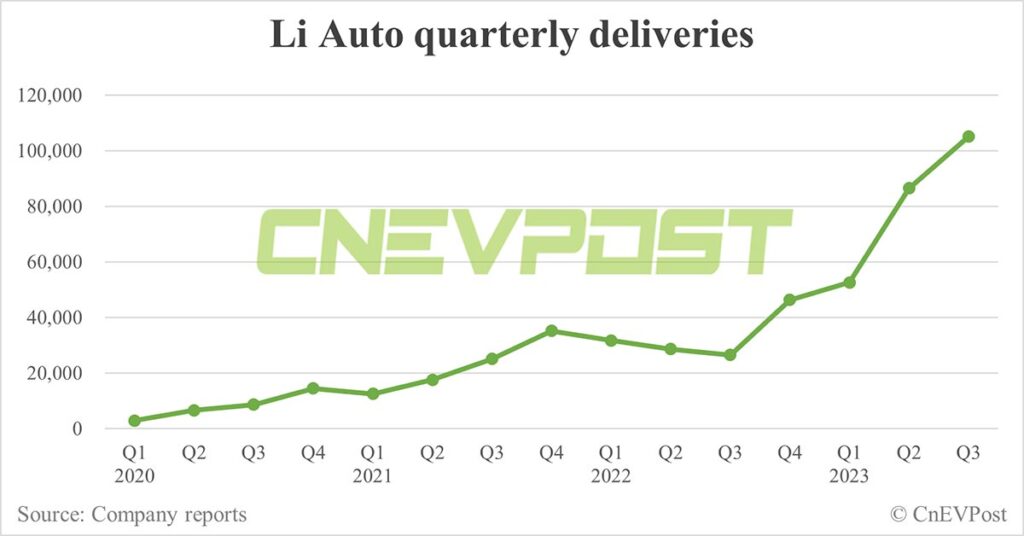

As background, Li Auto delivered 105,108 vehicles in the third quarter, marking the first time it has seen quarterly deliveries exceed 100,000 units, up 296.28 percent year-on-year and up 21.47 percent from the second quarter.

The company had previously guided for third quarter vehicle deliveries to be in the range of 100,000 to 103,000 vehicles and expected third quarter revenue to be in the range of RMB 32.33 billion ($4.4 billion) to RMB 33.30 billion.

“While demand for Li Auto’s premium EREV SUVs has remained robust, investor concerns around competition have increased especially around Huawei-backed Aito,” Yu’s team said in a November 1 research note sent to investors.

“Combined with already high volume expectations, we see some room to disappoint going forward especially around the upcoming BEVs where pricing will start quite high,” the team said.

Yu’s team expects Li Auto to report revenue of RMB 34.9 billion in the third quarter, with a gross margin of 22.9 percent and adjusted earnings of RMB 2.72 per share.

The current analyst consensus in a Bloomberg survey is RMB 32.6 billion, 21.9 percent and RMB 2.39, respectively, but that appears to be somewhat stale, so would certainly expect buyside expectations to be higher, Yu’s team noted.

The team expects Li Auto to post a vehicle margin of 22.5 percent in the third quarter, up 1.5 percentage points from the second quarter.

Li Auto’s gross margin in the second quarter was 21.8 percent, and its vehicle margin was 21.0 percent.

Yu’s team expects Li Auto’s management to guide fourth-quarter deliveries to be around 120,000 units, which would imply full-year deliveries of more than 360,000 and full-year revenue of around RMB 121 billion.

Li Auto released figures yesterday showing it delivered 40,422 vehicles in October, the first time it has exceeded the 40,000 mark. Li Xiang, the company’s founder, chairman and CEO, said earlier this week that Li Auto will challenge a higher target of delivering 50,000 vehicles a month.

Yu’s team expects Li Auto’s gross margins in the fourth quarter to be flat with the third quarter, at around 22 percent to 23 percent, with higher volumes offset by potentially small discounts.

Operating expenses should also increase sequentially due to more aggressive efforts in Li Auto’s development of ADAS (Advanced Driver Assistance System) and artificial intelligence, as well as higher marketing spending, the team said.

Despite deliveries remaining strong, Li Auto’s US-traded shares have performed weakly, falling about 30 percent over the past three months.

“We attribute most of the recent weakness in the stock to concerns around Aito’s emerging competitive threat which is a brand heavily backed by Huawei, using Seres as a manufacturing partner,” Yu’s team wrote.

On September 12, Huawei-backed Aito launched the new M7, allowing for a significantly lower starting price compared to the older model, and on October 31, Aito said the new M7 had accumulated more than 80,000 firm orders after 50 days on the market.

The updated version of the Aito M7 competes with Li Auto’s Li L7, and in relation, the upcoming Aito M9 is seen as a competitor to Li Auto’s L L9, Yu’s team noted.

Aito began pre-sales of its flagship SUV, the M9, on September 25, with the official launch set for December. On October 25, Aito said the M9 had more than 15,000 orders in pre-sales.

Yu’s team credits Aito’s success to Huawei’s support in marketing, channels, and software technology, including ADAS, the HarmonyOS UI and ecosystem, and the smart cockpit.

“That being said, we are not overly worried yet and believe Aito’s momentum will fade,” the team said.

Huawei is certainly a formidable force in China, but there were essentially no impact on deliveries in October, and Li Auto’s orders appear to remain healthy, the team said.

Aito announced yesterday that it delivered 12,700 vehicles in October, including 10,547 new M7s.

Back to Li Auto, the company plans to launch four new models in 2024, including the Li L6 extended-range electric vehicle (EREV), as well as three battery electric vehicles (BEVs).

Li Auto’s three models currently on sale — the Li L7, Li L8, and Li L9 — are all EREVs, and the company will launch its first BEV, the Li Mega MPV (Multi-Purpose Vehicle), in December, and its management had mentioned that the model is expected to be priced at more than RMB 500,000.

Yu’s team believes that at such a high price, the Li Mega may not sell well. For reference, the Zeekr 009 sells an average of 1,600 units per month.

“Our initial view is that L6 will be the main incremental volume driver, capitalizing off the success of the current EREV models, further penetrating into a lower price point (<300k RMB),” the team said.

Depending on the timing, the Li L6 could easily contribute more than 100,000 units next year, the team said.

“For the BEVs, we are more cautious on the volume trajectory given seemingly high pricing in the face of intense competition and lack of ecosystem,” the team said.

Li Auto management’s ambitious goal is to challenge German luxury carmakers Mercedes-Benz, BMW, and Audi for sales in China, suggesting more than 600,000 units in deliveries, the team said.

($1 = RMB 7.3179)

Li Auto delivers 40,422 vehicles in Oct, its 7th consecutive record-breaking month