Contents from Leapmotor’s Hong Kong IPO prospectus explain in detail the company’s business as well as its technologies.

Leapmotor announced a deal with European automotive giant Stellantis earlier today, and many wanted to know more about the background of the Chinese electric vehicle (EV) startup.

We dug into Leapmotor’s Hong Kong IPO prospectus and found some valuable information.

The following is excerpted from Leapmotor’s English-language prospectus dated September 20, 2022, and the company went public on September 29, 2022, in Hong Kong.

Note that since these were published a year ago, the company’s new business developments may make some of this information outdated.

Founded in 2015, we are a smart EV company based in China primarily focusing on the mid- to high-end segment of China’s NEV market with a price range of RMB150,000-300,000.

Our flagship models, the C11 and C01, provide longer driving range, greater acceleration, more interior space and a wider variety of autonomous driving functions than most models within the same price range available in China’s EV market as of the Latest Practicable Date.

We delivered a total of 43,748 vehicles in 2021, a 443.5% increase from 2020, making us the fastest-growing among the leading pure-play EV companies based in China in terms of delivery volume, according to Frost & Sullivan.

We delivered 51,994 smart EVs in the first half of 2022, representing an increase of 265.3% from the same period in 2021.

We internally develop all our key hardware and software across the core systems and electronic components of our vehicles. We are the only pure-play EV company based in China, and one of the few NEV companies in the China market (Note 1), with such a full-suite of R&D capabilities, according to Frost & Sullivan.

We develop cross-platform systems and electronic components from the ground up, which are highly configurable and easily adaptable across different EV models, making our R&D highly efficient and cost effective.

We are also the most vertically integrated pure-play EV company based in China, and one of the most vertically integrated NEV companies in the China market (Note 1), designing and producing in-house all of the core systems and electronic components for our vehicles, according to Frost & Sullivan.

These include our intelligent power system (Leapmotor Power), autonomous driving system (Leapmotor Pilot), and smart cockpit system (Leapmotor OS).

We believe such unique capabilities in smart EVs enable us to produce high caliber products, develop new models rapidly and enjoy a cost advantage.

China’s NEV market consists of four segment markets according to selling price of vehicles, namely (i) entry-level segment (below RMB80,000), (ii) mid-range segment (RMB80,000-below RMB150,000), (iii) mid- to high-end segment (RMB150,000 -RMB300,000), and (iv) premium segment (above RMB300,000).

The mid- to high-end segment in China’s NEV market is expected to be the largest and fastest-growing market segment from 2022 onwards, according to Frost & Sullivan.

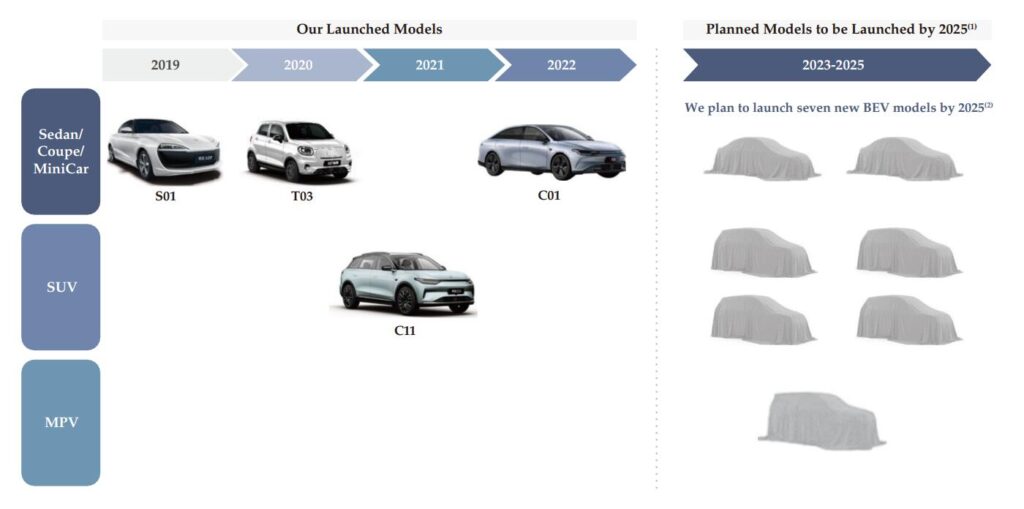

We have launched four BEV models and plan to further expand our product portfolio by launching seven new BEV models by 2025, at a pace of one to three new models every year.

As an addition to our product offering, we also plan to launch the EREV version of these new models based on our proprietary EREV technology, concurrently or subsequently, to broaden our target audience to include customers with different needs and preferences.

We believe our diversified product line-up will better position us to capture the market opportunities in the mid- to high-end segment of the NEV market in China.

We have established comprehensive in-house engineering and manufacturing capabilities with advanced technology. We produce smart EVs and their core systems and electronic components in our manufacturing plant in Jinhua, Zhejiang province.

This wholly-owned, AI-enabled, digitalized plant has a production capacity of 200,000 vehicles per annum. To capture the NEV market growth opportunities, we are also planning a new production facility in Hangzhou, Zhejiang province to further expand production capacity.

As a customer-centric company, we directly engage with our users through an integrated online/offline sales and service network.

We utilize a dual-pronged sales model, consisting of directly operated stores and channel partner stores, enabling us to swiftly scale up our network with capital efficiency and flexibility, while establishing direct customer relationships to best serve their needs.

We have developed a thriving user community through a variety of online and offline events initiated by us or directly by our users, such as test drives, product launches and Leapmotor Club gatherings, all of which enable greater engagement and interaction with our users.

Through these events, we collect and analyze valuable user feedback to continuously improve our product and service quality, thereby strengthening our connection with users and their trust in our brand.

Through omni-channel customer engagement and value-added services, we continue to acquire new customers as well as enhance user satisfaction, drive more user referrals and cultivate long-term user loyalty.

We compete in a large yet highly competitive market. There were approximately 70 automakers selling NEVs in China in 2021, according to Frost & Sullivan.

China was the world’s largest passenger vehicle market in 2021, according to Frost & Sullivan, with a sales volume amounting to approximately 20.9 million units. The penetration rate of NEVs in China’s PV market increased from 2.4% in 2017 to 16.0% in 2021 and is expected to surge from 22.4% in 2022 to 50.1% in 2026, according to the same source.

Meanwhile, NEVs have become increasingly popular among the mainstream consumer group. The mid- to high-end segment, with the price range between RMB150,000 and RMB300,000, is expected to become the largest and fastest-growing segment in China’s NEV market from 2022 onwards.

There were more than 60 automakers selling approximately 150 models in this segment in China’s NEV market in 2021, according to Frost & Sullivan.

We compete with both emerging NEV companies and ICE automakers operating in the NEV market. New NEV companies have been quick to capitalize on the NEV market opportunity with innovative smart technologies and product differentiation.

Meanwhile, ICE automakers are also quickly adapting to the fast-growing EV market by introducing their smart EV models, leveraging their legacies of established brand and traditional manufacturing know-how.

We compete with NEV manufacturers on key factors such as product features, quality, reliability and price, as well as design, brand awareness and user experience.

To remain competitive in the market, we are committed to launching a diverse product portfolio in current and future markets over the long term, leveraging our vertically integrated business model and full-suite of R&D capabilities.

The top five NEV companies accounted for 54.2% and 54.9% of market share by sales volume in China in 2021 and the first half of 2022, respectively, according to Frost & Sullivan.

We were the fourth largest pure-play EV company based in China by sales volume in China in 2021 and the first half of 2022, according to Frost & Sullivan.

According to the same source, we were ranked 19th and 14th in the China NEV market (comprising pure-play EV companies and ICE automakers operating in the NEV market) in terms of sales volume calculated based on vehicle insurance registrations in 2021 and the first half of 2022, with a market share of 1.6% and 2.2%, respectively.

We have a diverse and expanding portfolio of smart EVs. In July 2019, we started delivery of our first mass-produced model, the S01, a smart electric coupe. In May 2020, we started delivery of the T03, a smart electric mini car.

The T03 was a top three best-selling model by pure-play EV companies based in China by sales volume (based on consumer vehicle insurance registrations) in 2021 and the first half of 2022 , according to Frost & Sullivan.

In October 2021, we started delivery of the C11, a mid-sized smart electric SUV that provides one of the most comprehensive suites of autonomous driving features among EV models within its price range, according to Frost & Sullivan.

The C11 also features, a wide variety of smart interactive functions, generous interior space, and user-centric cabin design and configurations, offering a premium, smart mobility experience at a compelling price.

In May 2022, we launched the C01, a mid- to large-sized smart electric sedan. The C01 shares the same platform as the C11, and offers a variety of features that outperform other competing EV models within its price range, according to Frost & Sullivan.

At 5,050 mm in length, the C01 is the longest of any electric sedan within the same price range available in China’s EV market as of the Latest Practicable Date, matched only by the best-selling, higher priced premium EV models in the market.

With a 0–100 km/h acceleration in 3.7 seconds, the C01 Pro+ High Performance Edition has the fastest acceleration among all competing EV models within its price range.

Equipped with Leapmotor Power, the C01 Ultra-Long Range Edition has a CLTC range of up to 717 km, which is among the longest ranges on a single charge compared with EV models within the same price range available in China’s EV market as of the Latest Practicable Date.

With the delivery of the C01 in the third quarter of 2022, we expect to become the world’s first pure-play EV company to apply CTC technology in a mass-produced vehicle.

CTC technology enables the integration of the battery module, according to Frost & Sullivan with the battery tray and the vehicle body, breaking the boundaries between battery modules, packs and vehicles to result in longer range, faster acceleration, more interior space, improved collision safety and lower cost.

The C01 also offers 23 autonomous driving functions, one of the most comprehensive suites of such features among EV models within the same price range available in China’s EV market as of the Latest Practicable Date.

The table below sets forth certain specifications of our BEV vehicle models:

Notes:

(1) Specifications of each EV model vary due to the various versions available for each model.

(2) China Light-duty Vehicle Test Cycle, a testing standard to measure and establish a vehicle’s driving range developed by the CATARC.

(3) An indicator to describe the dynamic performance of a vehicle. A vehicle with more power will generally have better acceleration and higher maximum speed.

(4) An indicator for the acceleration performance of the vehicle, especially the acceleration at low speed.

(5) Indicative price.

We will further penetrate the mid- to high-end segment in China’s NEV market and cater to evolving and diverse customer needs by rapidly expanding and upgrading our product portfolio. We target to launch seven new BEV models by 2025, at a pace of one to three models every year covering sedans, SUVs, and MPVs in various sizes.

All of these seven new models will be developed on our A, C and D platforms focusing on the mid- to high-end segment in China’s NEV market. We design and develop each of these platforms to complement each other with distinctive attributes whilst catering to different segments of our target market.

This allows us to seize a greater share of market opportunities. As an addition to our product offering, we also plan to launch the EREV version of these new models based on our proprietary EREV technology, concurrently or subsequently, to broaden our target audience to include customers with different needs and preferences.

Notes:

(1) The expected time of delivery and exact format of future models might change.

(2) We also plan to launch the EREV version of these new models.

We internally develop and produce all key hardware and software across core systems and electronic components of our smart EVs with unified underlying interfaces, algorithms and data communication protocols.

This unique approach and capability make our cross-platform E/E architecture and vehicle architecture highly adaptable across EV models.

The following diagram illustrates the core systems and electronic components we develop and produce in-house:

Note:

(1) Sensors are developed and produced by our associate, Huaruijie Technology.

According to Frost & Sullivan, through our full-suite of R&D capabilities, we self-develop more types of key hardware and software for core systems than any other pure-play EV companies based in China, and most of the NEV companies in the China market (Note 1), including electric power systems, autonomous driving systems and smart cockpit systems.

For example, we design and develop our own hardware and software for the electric drive system, consisting of motor, gearbox and MCU, as well as the battery management system and VCU, while our peers typically source, or partially source, from third parties.

In addition, under our vertically integrated business model, we produce more types of hardware and software for core vehicle systems and electronic components in-house than any other pure-play EV companies based in China, and most of the NEV companies in the China market (Note 1), according to Frost & Sullivan.

We believe our full-suite of R&D capabilities and vertically integrated business model differentiate us from other pure-play EV players based in China and confer the following competitive advantages:

• Diverse portfolio of Smart EVs.

Our EVs provide a smart mobility experience with a variety of features that outperform other competing EV models within the same price range available in China’s EV market as of the Latest Practicable Date.

Leapmotor Pilot 3.0, our latest Level 2 autonomous driving system, enables 23 autonomous driving features, such as adaptive cruise control, highway autopilot, automated parking and early warning system.

This represents one of the most comprehensive sets of features among EV models within the same price range available in China’s EV market as of the Latest Practicable Date, according to Frost & Sullivan.

At present, vehicles equipped with Level 2 autonomous driving technology have found their places in wide-scale commercial productions and commercialization in China.

Meanwhile, some companies and research centers are testing vehicles equipped with Level 3 and above autonomous driving technologies in the specific scenarios of experimental and demonstration.

Leapmotor OS, our smart cockpit system, offers a broad spectrum of customizable smart interactive functions, as well as cloud-based services, through its IoV system.

Equipped with Leapmotor Power, the C11 delivers a CLTC range of up to 610 km for its Premium Edition and 0–100 km/h acceleration in 4.5 seconds for its Performance Edition.

With a 0–100 km/h acceleration in 3.7 seconds, the C01 Pro+ High Performance Edition has the fastest acceleration among all competing EV models within the same price range available in China’s EV market as of the Latest Practicable Date, according to Frost & Sullivan.

The C01 Ultra-Long Range Edition has a CLTC range of up to 717 km, which is among the longest ranges on a single charge compared with EV models within the same price range available in China’s EV market as of the Latest Practicable Date, according to the same source.

In addition, we offer comprehensive OTA updates and remote intelligent diagnostics functions to continuously improve product performance and user experience.

In particular, more than 85% of the ECUs of the C11 can be updated via OTA, including MCU, BMS, autonomous driving and smart cockpit systems.

• High R&D Efficiency.

Our cross-platform E/E architecture and vehicle architecture are highly adaptable across EV models, enabling us to develop new models within a shorter time frame, enhance R&D efficiency and scale up production quickly. We have launched four BEV models since 2019.

We expect to start delivering the C01, a mid- to large-sized smart electric sedan, in the third quarter of 2022, which would be one of the shortest intervals between consecutive deliveries of two models for any pure-play EV company based in China, according to Frost & Sullivan.

Leveraging our full-suite of R&D capabilities, we believe we can further expand and upgrade our EV portfolio rapidly, efficiently addressing the evolving needs and preferences of customers.

• Cost Advantage.

Our full-suite of R&D capabilities and in-house production of all core systems and electronic components allow us to simplify and streamline our supply chain with lower procurement and production costs. As we continue to grow, we believe this cost advantage will become increasingly apparent in the long run.

Note 1: The aforementioned NEV companies include domestic and international automakers that sell NEVs in China.

We have robust innovation and technological capabilities across the most critical areas in smart EVs:

E/E Architecture. We have developed proprietary E/E architecture on our mass-produced models that enables domain-centralized control of key vehicle systems, including autonomous driving, smart cockpit and vehicle control.

By adopting unified underlying interfaces, algorithms and data communication protocols across systems, our E/E architecture achieves a high degree of adaptability across EV models.

Moreover, we are currently developing the next generation of our E/E architecture, which utilizes a powerful centralized vehicle computing platform that is capable of processing highly complex functions.

• Electric Drive System.

We have developed a proprietary electric drive system with in-house hardware and software technologies. Heracles, the current generation of our proprietary electric drive system, integrates electric motors, MCUs and gearboxes to achieve high performance, and safety, while remaining light weight and cost efficient.

In 2022, we have commercialized a more advanced oil-cooling electric drive system called Pan Gu (盤古), featuring a maximum efficiency of up to 94.6%.

Moreover, with our deep learning algorithms and highly adaptable hardware, we can upgrade the electric drive system through OTA over the full vehicle lifecycle to continuously improve our vehicles’ driving performance.

• Battery System.

We developed our own battery pack and battery management technologies. Our proprietary thermal management system is compact and energy efficient, enabling the battery system to function at a temperature as low as –30°C.

With the planned delivery of the C01 in the third quarter of 2022, we expect to become the world’s first pure-play EV company to apply CTC technology in mass production, according to Frost & Sullivan.

CTC technology enables the integration of the battery module with the battery tray and the vehicle body, breaking the boundaries between battery modules, packs and vehicles. Specifically, it has reduced the number of components for the battery system by 20%, resulting in lighter vehicle weight, longer range, faster acceleration and lower cost.

The lightweight index is increased by 20%, while the vehicle body’s torsional strength is elevated by 25%, which improves collision safety. In addition, the safety of our battery system has been extensively tested and validated, with all testing results meeting the national standards.

The results of a number of relevant tests, such as vibration test, thermal diffusion test, enclosure test and several types of impact tests, have exceeded the mandatory national standard for batteries of electric vehicles (GB 38031-2020) and the optional standard for degrees of protection provided by enclosure (GBT/4208-2017).

The integrated structure increases the vertical space inside the vehicle and offers greater comfort for passengers.

• Autonomous Driving.

Leapmotor Pilot 3.0, our latest Level 2 autonomous driving system, provides 360-degree vision and 23 autonomous driving features, such as adaptive cruise control, highway autopilot, automated parking and early warning system.

This represents one of the most comprehensive sets of features among EV models within the same price range available in China’s EV market as of the Latest Practicable Date, according to Frost & Sullivan. Leapmotor Pilot 3.0 is powered by our full stack autonomous driving software, in particular, proprietary visualization algorithms with high processing accuracy.

In June 2021, our algorithms team won the first place in the Real Time 2D Detection Challenge at the 2021 Waymo Open Dataset Challenges, which speaks to our strength and leadership position in algorithms for autonomous driving.

It has been widely acknowledged by the industry that vehicle automation is categorized into six levels by the degree of driving automation, which is from Level 0 (no driving automation) to Level 5 (full driving automation) in the context of vehicles and their operations on roadways. See “Industry Overview — Levels of Autonomous Driving” for details.

• Smart Cockpit.

Leapmotor OS provides a wide variety of highly integrated interactive functions and enables automatic configuration of 25 customizable in-car settings based on user preference.

Leapmotor OS also offers cloud-based services through its IoV system, including remote vehicle control and mobile voice control. We will continue to add more functions to Leapmotor OS via OTA updates.

While we generally consider individuals who purchase our vehicles as our customers, we also account for channel partners as our customers as we sell our vehicles through them. We have a large customer base and we do not rely on any single customer.

Revenue generated from our largest customer for 2019, 2020, 2021 and the three months ended March 31, 2022 accounted for 6.8%, 5.1%, 2.3% and 1.7%, respectively, of our total revenue during those periods.

Revenue generated from our five largest customers during the Track Record Period accounted for 27.1%, 16.2%, 9.5% and 6.1%, respectively, of our total revenue during those periods.

Our major suppliers are suppliers of battery cells, automotive electronics and service providers. Purchases from our largest supplier for 2019, 2020, 2021 and the three months ended March 31, 2022 accounted for 5.4%, 21.4%, 19.1% and 16.2%, respectively, of our cost of sales during those periods.

Purchases from our five largest suppliers accounted for 17.1%, 28.2%, 33.7% and 35.4%, respectively, of our cost of sales for each of the same periods. See “Business — Our Suppliers — Our Major Suppliers.”

We believe the following competitive strengths contribute to our success:

• Full-suite of R&D capabilities;

• Most vertically integrated pure-play EV maker in China;

• Diverse portfolio of smart EVs;

• Proven ability to rapidly expand vehicle portfolio;

• Advanced autonomous driving and smart cockpit technologies; and

• Visionary management team with proven ability to execute.

We will pursue the following strategies to achieve our goals as identified below:

• We will develop a more advanced Leapmotor Pilot and upgrade Leapmotor OS as well as increase investment in the next-generation vehicle electrification technologies to offer better smart mobility experience and enhance driving performance of our smart EVs.

• We will further optimize the full process of R&D, supply chain management and EV and components manufacturing in order to enhance our vertical integration and operational efficiency.

We will also continue to invest in advanced intelligent and automated manufacturing facilities to further strengthen our EV and components production capabilities.

We will continue to penetrate the mid- to high-end segment by launching seven new BEV models by 2025 with one to three models every year. We also plan to launch the EREV version of these new models to attract customers with different needs and preferences.

• We will increase our brand awareness and strengthen its recognition by initiating a variety of online and offline marketing campaigns. We will also continue to increase the number of directly operated stores, channel partner stores and delivery and service centers to drive business growth.

• We plan to introduce in-vehicle pay-as-you-go and subscription-based value-added services to unlock new revenue We will also offer digital services and content in lifestyle, productivity and entertainment to provide users with a vibrant mobile lifestyle.

• We intend to strategically establish our international presence by entering into the European market. We plan to open our first overseas flagship store in Europe by 2023. Following that, we plan to expand our presence into other major markets and plan to become a global EV company.

Our business faces risks including those set out in the section headed “Risk Factors.” As different investors may have different interpretations and criteria when determining the significance of a risk, you should read the “Risk Factors” section in its entirety before you decide to invest in our Shares. Some of the major risks that we face include:

• Our research and development efforts may not yield expected results; • We have a limited operating history, which makes it difficult to evaluate our business and future prospects; • Our ability to manufacture and deliver automobiles of high quality and appeal to customers, on schedule, and on a large scale is unproven and still evolving;

• Our vehicles and smart technologies may contain faults and may not perform up to customer expectations;

• China’s NEV market is highly competitive, and demand for EVs may be cyclical and volatile;

• We recorded gross losses and net losses, and had negative net cash flows from operations in the past, which may continue in the future;

• We depend on revenue generated from a limited number of smart EV models;

We may be subject to risks associated with autonomous driving technologies; and

• Changes in government incentives or subsidies to support NEVs could adversely affect our business, financial condition and results of operations.