CATL‘s net profit fell 4.3 percent in the third quarter from the second quarter, as its share in China slipped and fell in September to a new low since April last year.

CATL, China’s largest power battery maker, saw its third-quarter net profit slump from the second quarter, as it continued to lose share in its home market.

CATL posted revenue of RMB 105.43 billion ($14.4 billion) in the third quarter, up 8.3 percent from a year earlier and up 5.2 percent from the previous quarter, according to its financial report released today.

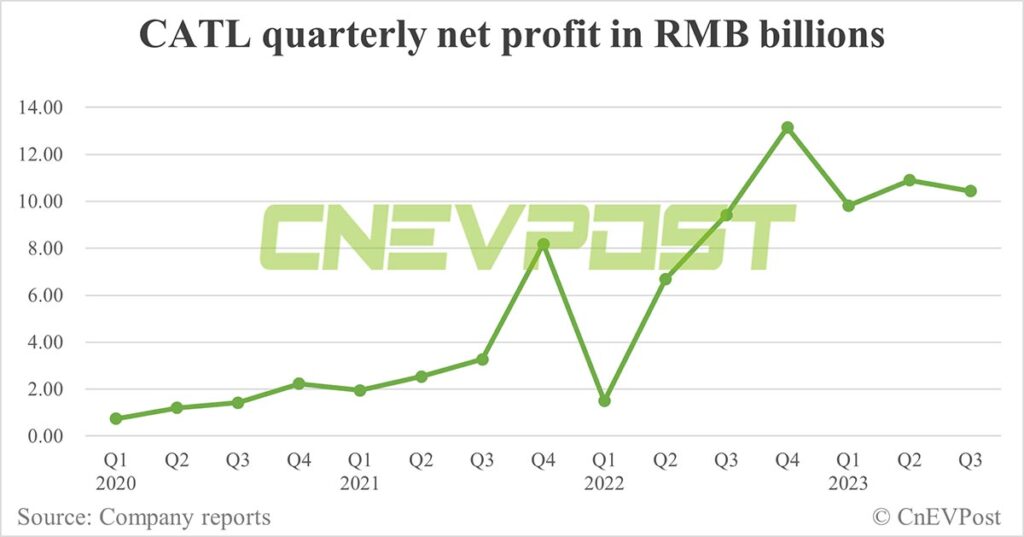

The company reported net profit of RMB 10.43 billion in the third quarter, up 10.7 percent year-on-year but down 4.3 percent from the second quarter.

It saw a gross margin of 22.42 percent in the third quarter, up 0.46 percentage points from the second quarter and significantly lower than its gross margin of nearly 30 percent for most of 2020 through 2021.

CATL remains the world’s largest power battery maker, with a 36.9 percent global share in the January-August period, the only one above 30 percent, according to South Korean market researcher SNE Research.

However, CATL’s share in China has slipped since the end of last year, falling to 39.41 percent in September, a new low since April last year, according to China Automotive Battery Innovation Alliance (CABIA).

That’s likely due to smaller rivals eating into its share at a time of overcapacity in power batteries.

CATL’s capacity utilization rate for battery systems fell to 60.5 percent in the first half of the year, down from 81 percent in the same period last year.

CATL’s bargaining power has slipped as prices for key raw materials for batteries plummeted amid overcapacity and increasingly fierce competition.

Earlier this month, Tianfeng Securities cut its third-quarter earnings forecast for CATL to 11 billion yuan from 11.5 billion yuan.

CATL had been gradually negotiating rebate programs with customers for next year in the third quarter, so it took early accruals for that, according to Tianfeng.

Rumors then surfaced that this could be due to CATL’s concessions to two key customers, Nio and Zeekr, and lowered battery prices.

CATL’s move may also be telling other automakers that battery prices are negotiable and will continue to fall, an auto blogger previously said.

($1 = RMB 7.3152)

CATL rumored to have given lower prices for batteries supplied to Nio and Zeekr