Battery-grade lithium carbonate prices are still sinking, but lithium suppliers have begun to cut production and the market is looking forward to the September-October demand season, TrendForce said.

Prices for lithium carbonate, a key raw material for batteries, have continued to fall over the past month, after seeing a brief rebound in the second quarter. However, the decline may not last much longer, according to a new report.

Lithium prices should stop falling and stabilize in September as Chinese lithium suppliers have begun to cut production, market research firm TrendForce said in a report yesterday.

Lithium batteries are used in electric vehicles (EVs), energy storage facilities, and consumer electronics, and with the rapid growth of the EV industry, demand from the sector has become key to lithium price trends.

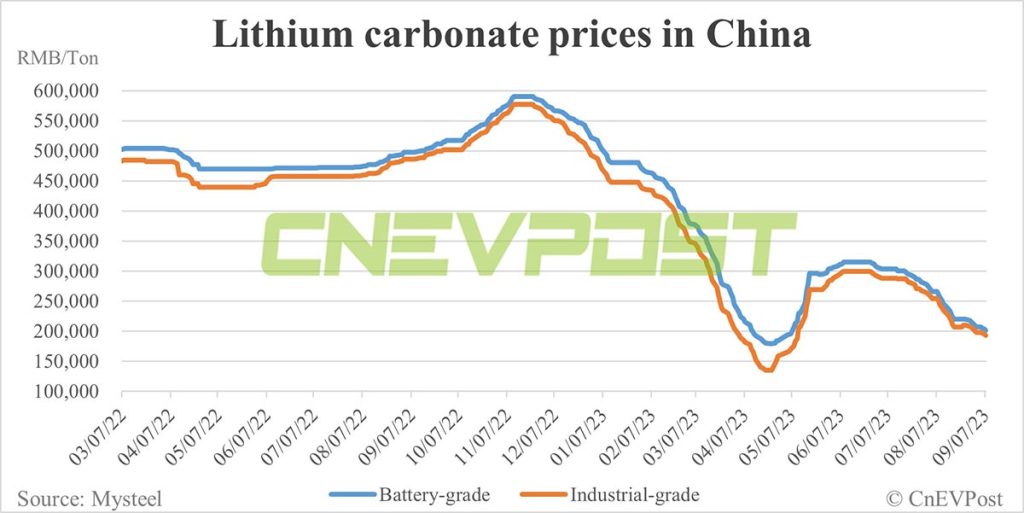

Weak demand in the power battery and energy storage markets has caused lithium prices to continue to fall, with battery-grade lithium carbonate averaging about RMB 230,000 ($31,380) per ton in August, down 20 percent in a single month, TrendForce said.

Currently, the price of battery-grade lithium carbonate is still sinking, threatening to fall below RMB 200,000 per ton, and buyers are expected to be more cautious in their purchasing attitudes and may continue to wait and see if there is a possibility of further decline, the report said.

Overall, however, lithium suppliers have begun to adjust production downward due to slow demand growth in the power battery market, and the market is looking forward to the September-October peak demand season, TrendForce said.

If this trend develops, lithium prices are expected to have a chance to stop falling and stabilize in September, and the demand for industry chain inventory replenishment should emerge, and the overall power battery market situation is expected to improve in September, according to the research firm.

However, if peak season demand is less than expected, the possibility of lithium price rebound will be reduced, TrendForce cautioned.

Lithium carbonate prices in China rose to about RMB 600,000 per ton at one point in November 2022, about 14 times the June 2020 average of RMB 41,000 per ton.

After that, however, lithium carbonate prices slumped and did not stop falling until the end of April this year. After a brief rebound in the second quarter, lithium prices resumed their decline over the past month.

In the EV battery sector, the average price of power batteries in China has fallen to RMB 0.6 per Wh in August, a one-month drop of about 10 percent, due to weak supply and demand, according to TrendForce.

The average price of automotive square ternary cells, lithium iron phosphate cells and soft pack ternary cells all fell by about 10 percent, and they were priced at RMB 0.65 per Wh, RMB 0.59 per Wh, and RMB 0.70 per Wh in August, respectively, TrendForce said.

In the field of energy storage battery cells, market demand in August was less than expected, while the production pace of battery cell manufacturers slowed down due to weakening overseas demand, according to the report.

Prices of energy storage batteries have continued to fall, with the average price having fallen below RMB 0.6/Wh in August.

With China’s energy storage battery cell production capacity now in surplus, a price war in the sector will be difficult to avoid, and prices are expected to continue to decline slowly this year, TrendForce said.

In terms of consumer batteries, demand in the consumer electronics market was weak in August, with battery manufacturers focusing on digesting inventory.

With lithium and cobalt tetraoxide prices not yet seeing a stop to the downward trend, consumer battery cell makers have low willingness to stock up, instead focusing on maintaining stable production, TrendForce said, citing their survey, adding that lithium cobalt oxide cell prices are expected to remain on the downward trend in September.

($1 = RMB 7.3293)