- The auto business was the main reason for Tesla‘s weaker-than-expected results, as incentives were more aggressive than expected.

- Gross margin in the fourth quarter was 16.3 percent, about half of what they were in the first quarter of 2022.

Tesla (NASDAQ: TSLA) reported weaker-than-expected fourth-quarter earnings, with gross margins falling significantly, as promotional activity became more intense.

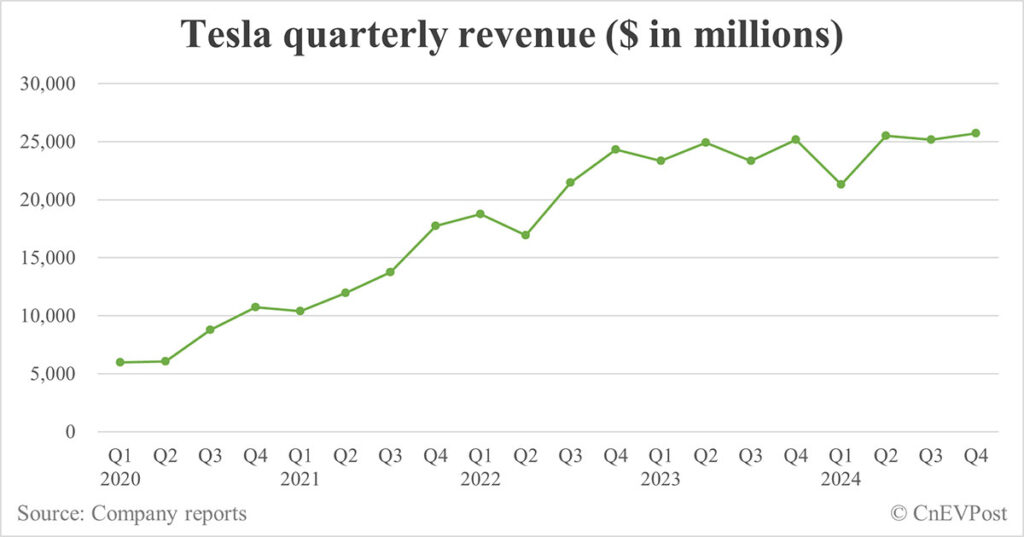

The US electric vehicle (EV) maker reported record revenue of $25.7 billion in the fourth quarter of 2024, but missed the consensus estimate of $27.2 billion, according to its earnings report released overnight.

This is up 2.15 percent year-on-year and up 2.08 percent from the third quarter.

Tesla’s gross profit in the fourth quarter was $4.18 billion, down 5.84 percent year-on-year and down 16.37 percent from the third quarter.

Its gross margin of 16.3 percent in the fourth quarter was roughly half of what it was in the first quarter of 2022, a decrease of 1.3 percentage points from the fourth quarter of 2023, and a decrease of 3.5 percentage points from the third quarter of 2024.

Tesla previously released data showing that it delivered 495,570 vehicles in the fourth quarter, below the consensus estimate of 512,277.

That’s up 2.28 percent from 484,507 in the same period in 2023 and up 7.06 percent from 462,890 in the third quarter.

Tesla’s less expensive Model 3 sedan and Model Y crossover delivered a total of 471,930 units in the fourth quarter, below market expectations of 484,575.

The auto business was the main reason for Tesla’s weaker-than-expected results, as incentives were more intense than expected, leading to lower average selling prices, Deutsche Bank analyst Edison Yu’s team said in a research note today.

Gross margin was also lower, with automotive gross margin coming in at 16.6 percent, 200 basis points below Deutsche Bank’s previous estimate, the team noted.

Excluding credits, this equated to a 13.6 percent margin, down 350 basis points from the prior quarter and below Deutsche Bank’s estimate of 15.5 percent, the team said.

Compared to the previous quarter, fourth-quarter auto margin was notably disappointing due to aggressive incentives, Yu’s team said.