Zeekr saw its net loss decrease by 37.0 percent in the third quarter, while lower battery pack sales dragged down revenue.

Zeekr (NYSE: ZK) saw its net loss narrow significantly in the third quarter, despite a slight decline in revenue, as vehicle deliveries were essentially flat from the previous quarter.

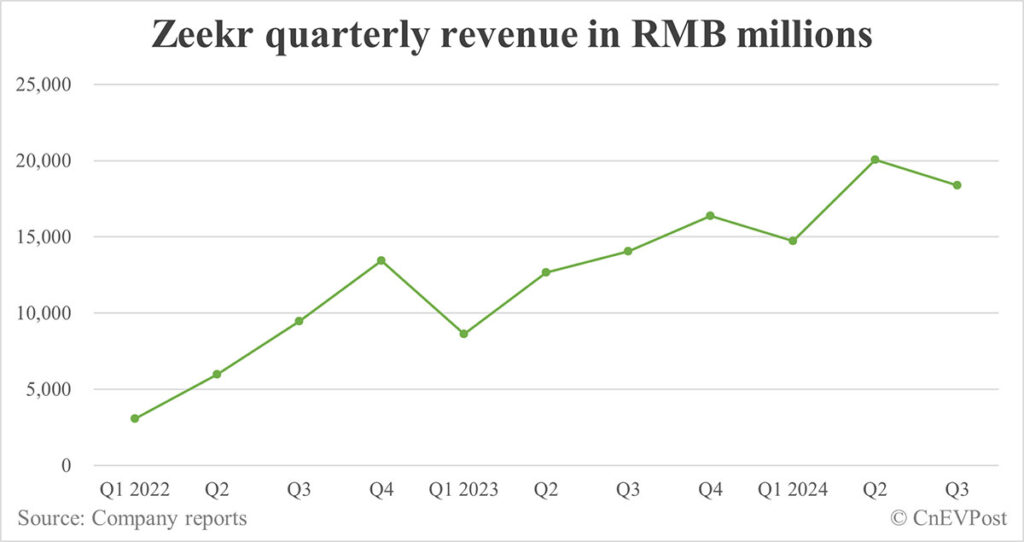

The Chinese electric vehicle (EV) maker reported revenue of RMB 18.36 billion ($2.62 billion) in the third quarter, missing analysts’ estimates of RMB 19.71 billion in a Bloomberg survey, according to its unaudited results announced today.

That’s up 30.71 percent from the third quarter of 2023 but down 8.39 percent from the second quarter of 2024. The company had not previously provided guidance on revenue or deliveries for the third quarter.

Zeekr delivered a record 55,003 vehicles in the third quarter, up 51.13 percent year-on-year and up 0.35 percent from the second quarter, according to data compiled by CnEVPost.

It generated a record revenue of RMB 14.4 billion from vehicle sales in the third quarter, an increase of 42.0 percent from the third quarter of 2023 and an increase of 7.2 percent from the second quarter of 2024.

The increase was due to higher new product deliveries, the launch of the new Zeekr 7X model in the third quarter, and higher average selling prices due to changes in product mix, Zeekr said.

Revenue from sales of batteries and other components for the third quarter was RMB 3.25 billion, a decrease of 1.3 percent from the third quarter of 2023 and a decrease of 38.8 percent from the second quarter of 2024.

The sequential decline was mainly due to lower battery pack sales in the domestic market, Zeekr said.

Zeekr’s net loss for the third quarter was RMB 1.14 billion, a decrease of 21.75 percent from the third quarter of 2023 and a decrease of 37.02 percent from the second quarter of 2024.

Excluding equity incentive expenses, non-GAAP adjusted net loss for the third quarter was RMB 1.09 billion, a decrease of 23.4 percent from the third quarter of 2023 and an increase of 26.3 percent from the second quarter of 2024.

Zeekr reported a gross margin of 16.0 percent in the third quarter, above analysts’ expectations of 15.3 percent in a Bloomberg survey. The figure was 16.3 percent in the third quarter of 2023 and 17.2 percent in the second quarter of 2024.

The sequential decline in gross margin was mainly attributed to lower margins on batteries and other components, the company said.

Vehicle margin was 15.7 percent in the third quarter, compared to 18.1 percent in the third quarter of 2023 and 14.2 percent in the second quarter of 2024.

The year-on-year decrease was primarily attributable to lower average selling prices for vehicles, partially offset by purchase savings from lower auto parts and materials costs. The sequential increase was primarily attributable to changes in product mix.

Research and development expenses for the third quarter were RMB 1.97 billion, a decrease of 2.6 percent from the third quarter of 2023 and a decrease of 25.1 percent from the second quarter of 2024.

The decline from the second quarter was mainly due to a one-time, significant equity incentive charge in the second quarter, which was related to the company’s initial public offering.

As of September 30, 2024, Zeekr had cash and cash equivalents and restricted cash of RMB 8.3 billion.

Zeekr, as before, did not provide delivery or revenue guidance for the next quarter.